Personal Insurance

- Auto Insurance

- Home Insurance

- Motorcycle Insurance

- Am I covered no matter where I go ?

- How to lower my premium

- Claims Service Guarantee

- Safety on the Water

- Recreational vehicle insurance (Trailers, Campers Motor homes)

- Aviation insurance

- Off-Road Vehicles and snowmobile Insurance

- Travel Insurance

- Auto and Home Insurance in Florida

Printable PDF Version RSA - Pleasure Craft Insurance

At Royal & SunAlliance, Yachtworks is our suite of products designed for pleasure crafts. It includes:

Simply P&I - a Value-Oriented Liability PolicySimply P&I offers the customer an alternative to the standard "All Risk" type policies for which they must purchase both physical damage and liability coverage. Available at a considerably lower cost, Simply P&I includes $2million Protection & Indemnity liability plus extras such as Wreck Removal coverage in a value conscious package.

First Mate - an All Risk Agreed Value Replacement Cost (AVRC) PolicyThe First Mate program is the entire pleasure craft insurance package, being both a broker quoting system and comprehensive AVRC All Risk yacht policy. For qualifying customers, First Mate includes all of our standard policy coverages, plus has optional deductibles, extra coverages, and higher liability limits available.

Complete - a Custom-Tailored All Risk PolicyYachtworks Complete is just that, the complete yacht insurance policy. Based on our comprehensive AVRC All Risk wording, it can be customized to suit virtually everyone's yacht insurance needs. Complete is available to a wide range of yachts, whether powered by motor or sail.

Lakestar - our Premium All Risk Policy for Higher-Valued YachtsLakestar is the answer to how you improve on an already great insurance policy. It is an AVRC All Risk wording, plus many extra coverages and enhancements included in one premium package. Designed to suit the needs of higher valued yachts, Lakestar also provides optional coverages not seen in other wordings to qualifying customers such as extended navigation, replacement cost protection, and 1st claim free.

Advantage - an All Risk Policy Tailored to Performance Class Boats.Finding an insurance policy for higher powered or performance vessels is not easy, so Advantage is the solution. Advantage is based on our AVRC All Risk form, and has been modified to recognize the unique nature of this class of power craft.

The information on this website is intended for promotional purposes and is not an insurance policy. It is not an offer of insurance. It contains some information about coverage offered by Royal & SunAlliance but does not list all the conditions and exclusions which apply to described coverage. The actual wording of the policy and local law govern all situations. The products and coverage described may not be available in all jurisdictions, and are subject to change. Please speak with your broker who can provide details on the products and services best suited to your needs.

You want to learn more or would like to get a quote?

Conception Vortex Solution

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Yacht Insurance

Protect your superior watercraft with superior protection from Chubb.

Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon. It’s an experience you want to protect. Our Masterpiece® Yacht insurance policy offers superior coverage for pleasure yachts 36 feet or greater in length. And for captained vessels 70 feet or greater in length and valued at $3 million or more, our Masterpiece Yacht Preference policy has the specialty coverages you and your crew need.

Masterpiece® Yacht Policy Highlights

Agreed Value Coverage

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Yacht Select policy, eligible vessels can receive Replacement Cost coverage up to 120%.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, liability as required by the Oil Pollution Act of 1990, wreck removal, and Jones Act coverage for paid crew.

Replacement Cost Loss Settlement

Repair or replacement of covered property is paid for without deduction for depreciation for most partial losses.

Uninsured/Underinsured Boater Coverage

Pays for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per person basis, rather than per occurrence. Optional and customized limits are available.

Search & Rescue

Up to $10,000 for the expenses incurred by an insured in relation to a governmental unit such as the United States Coast Guard (USCG) who provide emergency aid and assistance are included for no additional charge. With our Masterpiece Yacht Select option, coverage is available up to $25,000.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When Liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

Trailer Coverage

We automatically include coverage up to $5,000 for your trailer used with your insured vessel. Higher limits are available.

Emergency Towing & Assistance

Our policy includes this coverage with optional higher limits available.

Boat Show & Demonstration Coverage

We automatically provide this coverage, at no additional charge.

Precautionary Measures

We will pay up to the policy limit the reasonable costs incurred to haul, fuel or dock the insured watercraft endangered by a covered peril.

Bottom Inspection

We will cover the reasonable costs to inspect the bottom of an insured vessel after grounding, stranding, or striking a submerged object. There is no deductible for this coverage.

Oil Pollution Act of 1990 (OPA) Coverage

If Liability coverage is purchased, our policy provides coverage in addition to the Liability limit, up to the required OPA statutory limits, regardless of the Liability limit chosen. Additionally, if the OPA statutory limit is increased in the future, our policy will automatically increase the applicable OPA limit to match the new higher statutory limits.

Temporary Substitute Watercraft

Up to $5,000 to charter a temporary substitute watercraft if the insured vessel is out of commission due to a covered loss and cannot be repaired within 72 hours. With our Masterpiece Yacht Select policy offering, the limit of Temporary Substitute Watercraft is increased to $10,000.

Marine Environmental Damage Coverage

This feature provides protection up to $10,000 for fines and penalties as a result of marine environmental damage, as defined by the policy terms. Coverage is provided in addition to the insured's applicable Liability and OPA limits. With our Masterpiece Yacht Select policy offering, the limit of Marine Environmental Damage Coverage is increased to $25,000.

57% of boating accidents happen on calm days with waves less than 6 inches.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece Yacht Preference

Masterpiece Yacht Preference fulfills the specialty insurance needs of luxury yacht owners with captained vessels 70 feet in length and greater, valued at $3 million or more.

No depreciation applies on the following items

Machinery inside the hull, Personal Property, dingy/tender, and Personal Watercraft.

Emergency Towing Service

We include coverage up to the amount of Property Damage with no deductible.

The medical payments limit offered is on a per occurrence basis, and we will pay costs incurred up to three years from the date of occurrence.

Marina as Additional Insured

The marina, yacht club, or similar facility where the insured yacht is docked, moored, or stored is included as an Additional Insured.

Captain and Crew Coverage

Liability coverage is extended to the captain and crew members serving aboard the insured yacht.

Defense Costs

Defense costs are included in addition to the limit of liability and includes up to $50,000 loss of earnings.

Mooring or Slip Rental Agreement Waiver

When waiver of subrogation is required through a written contract by a yacht club, marina, or similar facility used for the purpose of storage or slip rental, our Masterpiece Yacht Preference policy will permit an insured to waive their rights of subrogation.

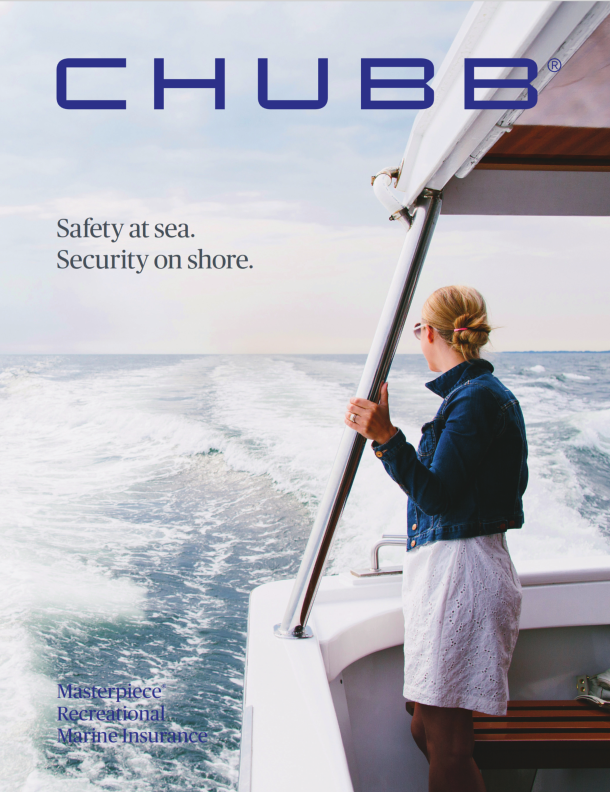

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

We provide exceptional boat insurance with tailored protection.

We help you stay ahead and informed with these helpful tips and tricks

12 safety tips for recreational boaters

As the weather warms up, many of us head to lakes, rivers, or the ocean to fish, waterski, cruise, and relax onboard a boat, yacht or other personal watercraft.

Understanding boat insurance

A comprehensive guide to finding the right boat insurance coverage.

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

- Search Search Please fill out this field.

- Personal Finance

Yacht Insurance: What It Means, How It Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

What Is Yacht Insurance?

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or damage to the property of others and damage to personal property on the vessel. Depending on the insurance provider, this insurance could also include gas delivery, towing, and assistance if your yacht gets stranded.

Key Takeaways

- Yacht insurance provides indemnity liability coverage for a sailing vessel.

- It has two principal parts: hull insurance and protection and indemnity (P&I) insurance.

- While there is no legal agreed upon length that separates a yacht from a pleasure boat, generally it is considered to be somewhere between 27 and 30 feet.

Understanding Yacht Insurance

Some companies specialize in providing coverage for antique and classic boats. You can choose between an actual cash value or agreed value policy. The former is cheaper but factors in depreciation and market value, so your payout will be less. Some policies include discounts based on your boating education, safety features, and whether you have a hybrid or electric boat. Some companies also offer a package deal that decreases the rate on a yacht insurance policy if you purchase additional policies, such as for your home or car.

Boats are defined as vessels under 197 feet long, while ships are 197 feet long or longer. There is no agreed upon length for a yacht , but they are generally considered to be at least 30 feet long. A vessel under 27 feet is considered a pleasure boat.

Although there isn't a standard definition of what the size of a yacht is, we can see that there is a general agreement within a range. With that being said, this general range falls within class 2 and class 3 of the Federal boat classification system.

For its own purposes, the National Boat Owners Association marks the dividing line at 27 feet. Most yacht coverage is broader and more specialized than pleasure boat coverage, because larger vessels travel farther and are exposed to greater risks.

Yacht insurance is broader and more specialized than pleasure boat coverage, due to the fact that a yacht can sail farther and thus runs greater risks.

A yacht insurance deductible, the amount of money you must pay out of your own pocket before your insurance kicks in, is usually a percentage of the insured value. A 1% deductible, for example, means that a boat insured for $100,000 would have a $1,000 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

Two Parts of Yacht Insurance

There are two principal sections of a yacht insurance policy.

Hull insurance

Hull insurance is an all-risk, direct damage coverage that includes an agreed amount of hull coverage. That amount is settled on when the policy is written, and in the case of a total loss it will be paid out in full. In addition, there is replacement cost coverage on partial losses, though sails, canvas, batteries, outboards, and sometimes outdrives are not include and instead are subject to depreciation.

Protection and indemnity (P&I)

Protection and indemnity (P&I) insurance is the broadest of all liability coverages, and because maritime law is particular, you will need coverages that are designed for those exposures. Longshore and harbor workers’ coverage and Jones Act coverage (for the yacht’s crew) are included and important, because your losses in these areas could run into six figures. P&I will cover any judgements against you and also pays for your defense in admiralty courts .

Insurance Information Institute. " Boat insurance and safety: Boat insurance coverage ." Accessed Jan. 31, 2022.

National Boat Owners Association (NBOA). " The Best Yacht Insurance Rates ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Insurance Discounts ." Accessed Jan. 31, 2022.

Malhotra Insurance. " Watercraft and Boat Insurance: Is There a Difference? " Accessed Jan. 31, 2022.

U.S. Government Publishing Office. " Coast Guard, DOT ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What is a normal deductible? " Accessed Jan. 31, 2022.

Absolute Insurance of Palm Beach County, Inc. " Yacht Insurance ." Accessed Jan. 31, 2022.

International Marine Underwriters. " Commercial Hull and P&I ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What should I look for in a yacht policy? " Accessed Jan. 31, 2022.

Gallagher Charter Lakes. " Protection & Indemnity Insurance – What is it??? " Accessed Jan. 31, 2022.

- Property Insurance: Definition and How Coverage Works 1 of 21

- The Importance of Property Insurance 2 of 21

- What Is Personal Liability Insurance? Definition and Coverage 3 of 21

- Scheduled Personal Property: What it is, How it Works 4 of 21

- Unscheduled Personal Property: What It Is, How It Works 5 of 21

- Floater Insurance: What it is, How it Works, Examples 6 of 21

- Unscheduled Property Floater 7 of 21

- Wear and Tear Exclusion: What it is, How it Works, Claim Disputes 8 of 21

- A Quick Guide on How to Insure Jewelry 9 of 21

- Jewelry Floater: What Is It, and How Does It Work With Insurance? 10 of 21

- Special Insurance for Designer Clothes 11 of 21

- Consignment Insurance: What It Is, How It Works 12 of 21

- A Quick Guide to Landlord Insurance 13 of 21

- Best Landlord Insurance Companies 14 of 21

- Mobile Home Insurance: Do You Need It? 15 of 21

- Modular vs. Manufactured Home Insurance 16 of 21

- Tiny House Insurance: How to Insure Your Tiny Home 17 of 21

- Watercraft Insurance: What It is, How It Works 18 of 21

- Yacht Insurance: What It Means, How It Works 19 of 21

- What Is Umbrella Insurance Policy? Definition and If You Need It 20 of 21

- How an Umbrella Insurance Policy Works 21 of 21

:max_bytes(150000):strip_icc():format(webp)/jet_ski_103967155-56a0e1d45f9b58eba4b4cd01.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Why choose Burgess yacht insurance?

Yacht insurance.

Discover the Burgess difference

Owning a yacht is both an emotional decision and a financial investment. At Burgess, we source the best possible insurance to protect your asset and guide you through the risks of ownership.

Integrated risk management expertise and experience

We pride ourselves on providing a personal service and first-class level of cover, with insurance, operational and technical teams all working together to manage and mitigate risk. For a wide range of cover types relating to yacht ownership, charter and crew, we devise insurance solutions that fit.

Global coverage across all insurance markets

Our access to the insurance markets world-wide, paired with the contacts and expertise of our insurance team, means we obtain the most competitive rates on all yacht insurance premiums. We tailor solutions to fit all of your yacht insurance needs.

Underpinned by 35 years of successful claims outcomes

As an FCA-regulated company with 35 years’ experience, we work with leading insurance firms that have placed cover for 35 of the world’s 50 largest superyachts. Whatever your requirements, we only work with those firms that we know can deliver when needed.

Achieve peace of mind

Cost-effective insurance provided in house. We take care of it, so you don’t have to

- Yacht Management

Charter Management

- Yacht Marketing

- Sales Management

- Berths for sale

Procurement

- Crew Services

Sold: one of the world's best berths

Talk to the Burgess expert... Gabriela Szmigielski

Why is Burgess yacht insurance better?

Thanks to you, Burgess nears its 49th year on a high

Sold: 74.5m Amels LADY E

Purchased: 47m Alloy Yachts LORETTA ANNE

Sold in-house: 40m SO NICE

Sold: 31m ESTEL

Sign up to our newsletter, stay in the loop.

Subscribe to our newsletter to keep updated with all things Burgess.

What would you like emails about?

- Chartering a yacht

- Buying or selling a yacht

- General superyacht news

In order to understand how we use and protect your personal information, please read our privacy policy .

- Mediterranean

- French Riviera

- Corsica & Sardinia

- The Balearics

- Croatia & Montenegro

- The Bahamas

- Caribbean - Leeward Islands

- Caribbean - Windward Islands

- British Virgin Islands

- US Virgin Islands

- New England

- Indian Ocean

- South East Asia

- French Polynesia

- The Red Sea

- Motor yachts for charter

- Sailing yachts for charter

- Latest offers

- Destinations

- New to charter

- Meet the Charter team

- Superyacht videos

- 360° yacht tours

- Corporate & event charters

- Inspiring charter ideas

- Charter FAQs

- Every day different

Charter NAIA

Available in the West Med or Adriatic this summer

Exciting fleet of tenders and toys to keep everyone active, plus gym, jacuzzi and on board masseuse

Available in the Balearics this summer

Exhilarating 25 knot performance, huge sunpad and open-air lounge plus stunning beach club

- Motor yachts for sale

- Sailing yachts for sale

- Yachts for sale over 200 feet

- Yachts for sale from 150 to 200 feet

- Yachts for sale under 150 feet

- Tenders and chase boats for sale

- Yachts under construction

- Meet the Brokerage team

- Sold yachts

- Yacht marketing

- Delivered yachts

- Yacht designers

- New Build Sales

- Meet the Technical Services team

- Meet the Yacht Management team

- Crew vacancies

- Meet the Crew Services team

- Procurement Services

- Charter Management

- Meet the Insurance team

- 360 degree yacht tours

- Boat shows and events

- Office vacancies

- Talent pool

- Office locations

- Burgess in Asia

- Burgess Blue Oceans

- Strategic partners

- Press centre

- Company Operations

- New Business

- Technical Services

Filter your results

- Yachts for charter

- Yachts for sale

- AB Inflatables

- Limitless Seas

- Hunt Yachts

- New Inventory

- Pre-owned Inventory

- Outboard Service & Repower

- Boat Storage

- Request a Quote

- Financing Application

- Meet the Team

- Yachting Insider

- RestoMod/Tuning

- Types of Yachts

- Outboard Service and Repower Center

- Volvo Penta

- Finance Application

- About Us / History

- YACHTING INSIDER

- Resto-mod Gallery

Understanding Boat Insurance

How To Buy a Boat

Dock Space Reservation Platforms

Getting the right insurance.

When you own something valuable, it’s important to protect your investment. Just like how car and homeowner’s insurance protect your vehicle and property, having sufficient coverage on your boat safeguards you and your vessel against the various risks of being on the open water. It also ensures peace of mind when accidents occur on the waterways.

It can be difficult to know how much and what kind of boat insurance you need for various watercraft types. To help you choose the best policy for your lifestyle, this post provides an overview of boat and yacht coverage basics so you can understand what type of insurance would suit your boating needs. Read this article to learn how to:

- Understand insurance basics including requirements, expected costs, and choosing coverage.

- Select coverage and policy types based on your boat and your needs.

- Find and obtain coverage that works for you.

Insurance Basics

Need, cost, & coverage.

Whether you’re buying a new or used boat, you want to protect your watercraft with an insurance plan from a company you can trust. Boat insurance companies offer a wide range of policies at various rates, which can make finding the right type of coverage confusing for new boat owners and stressful for seasoned sailors.

Despite these difficulties, there’s no doubt that all boat owners should have some kind of insurance, especially liability coverage. Below, we’ll answer some of the most common initial questions people ask while shopping for marine insurance policies to protect their new or used boats and yachts.

When Do I Need Boat Insurance?

Sufficient boat insurance should be in place before you set out on the water for the first time. Insuring your vessel is actually one of the final steps of the boat buying process, so coverage usually starts as soon as the watercraft is in your name.

“The rule of thumb is you want and need to have insurance coverage bound on your boat as soon as you take ownership of it,” says Christopher Kemp, Director of Finance and Insurance at Yachting Solutions.

If you need to have your boat delivered to you after purchase, your policy should also include coverage for transportation, whether it be over the road or on the water. Having that safety net in place as soon as you buy your vessel ensures protection from the start and gives you peace of mind in the event of an accident during transport.

Who Requires It?

Marine insurance is different from car and homeowner’s insurance in that the law does not usually require you to have it. While you can own and operate a boat without coverage, having marine insurance protects you from the financial and legal ramifications of any unfortunate accidents that may occur while boating, including property damage or loss of life.

Arkansas and Utah are the only two states in the U.S. with boat insurance laws requiring boaters to have liability insurance on all PWC and any motorboats that run at more than 50 horsepower. In other states, commercial boat owners will need to get an inland marine insurance policy from a boat insurance company before navigating the lakes, rivers, and other waterways inside various inlets.

Other locations and entities that may require you to have insurance are:

While you may be able to drive your boat on the coast of the Carolinas without insurance, you might be unable to dock at a marina or stow your vessel over the winter unless you have a protection plan in place. Most marinas and boatyards require boat owners to have Protection and Indemnity coverage, which is a type of liability insurance that we’ll go over later in this article.

Banks and Lenders

If you plan to finance your boat either through a specialized marine lender or bank, chances are that financial institution will require you to have insurance before giving you the loan. Usually, the Finance and Insurance (F & I) Department at the boat dealership handles the process of financing and insuring a vessel.

How Do I Know What Coverage I Need?

When shopping for marine insurance, there are a lot of factors you should consider. Having a qualified marine insurer to go over the different types of coverage available and policies that match your needs is the best way to make sure you select the most suitable insurance plan for your lifestyle.

Ultimately, the policies you pick will depend on the type of boat you want to insure, how you intend to use it, where you plan to sail and store it, and whether there is any special equipment aboard. You’ll also need to consider additional details about your boat, including its:

- Speed/Horsepower

- Current Condition

- Number of Owners

- Type of Cargo (if any)

What Does Boat Insurance Cover?

You won’t find any standard, one-size-fits-all policies on your search for proper insurance. Boat insurance companies determine the coverage you need by looking at where and how you use your vessel. Generally, the plan you choose will either be an all-risk policy or a named perils policy.

An all-risk policy ensures the general protection of your vessel. It covers all risks of physical loss or damage to your boat from external causes, except for those specifically excluded in the policy. In some cases, an all-risk policy may not cover things like wear and tear, marring, denting, manufacturer or design defects, and freezing.

Named-Perils

A named-perils policy covers physical loss or damage to a boat only from the perils specifically stated in the policy. These often include damage or loss from fire, heavy weather, or theft. You can also add non-sea-related perils such as damage due to negligence of a crew, charterers or repairers, or latent defects depending on how you use your vessel.

Additional Coverage

Insurance companies offer extra coverage options such as insurance for personal effects, uninsured boater liability, and towing and assistance services. Although permanently-attached equipment already has coverage, you may ask for specialized insurance for navigation equipment and other expensive features. Some companies offer cruising extensions if you plan to leave the U.S. temporarily.

Other types of coverage you may need for your boat or yacht include:

- Boat trailer coverage

- Fishing tournament reimbursement

- Protection for fishing equipment

- Reimbursement for trip interruption

- Paid captain and crew coverage

- Protection while in transit

- Boat lift coverage

How Much is Boat Insurance?

According to Kemp, your experience as a boater plays a major role in how insurance companies calculate premiums. Insurance applications include questions about your boating history and experience to gauge how well you know the ins and outs of operating a vessel. Marine insurance companies will also consider:

- Driving Record: Both your boating and driving record help insurers determine whether you’d pose a risk to other vessels while navigating the waterways. Their findings can affect the price of your premium.

- Safety Training and Education: If you’ve taken a boating safety course, Captain’s classes, or any courses with the U.S. Coast Guard, most companies offer a discount on your premium.

- Deductible: The higher your deductible or out-of-pocket costs, the lower your premium.

- Location: Your cruising area, or where you plan to boat, determines costs of insurance as well. Boaters who cruise international waters, for example, might pay more than boaters staying inland.

How Much Do I Insure My Boat For?

When it comes to boat insurance costs, there are two types of policies that determine the price of your overall coverage plan:

Agreed Value

Also called “stated value” coverage, agreed value policies cover your boat based on its current (at the time you sign the policy) value. Essentially, it insures your vessel for the amount it would cost to replace it with a boat of similar kind and quality. Agreed value policies can cost more upfront, but the lack of depreciation for total loss of the vessel makes the price worth it over time.

Actual Cash Value

While the actual cash value policy is more affordable, you will have to deal with depreciation. With this policy, the insurer will only pay up to the actual cash value of the vessel when declared a total or partial loss. As your boat gets older, your insurer may advise you to choose an actual cash value policy to save money.

Policy Types

Marine insurance policies & coverage.

Some homeowner’s insurance policies cover small vessels such as paddle boats or small sailboats under 26-feet long. Yachts are longer than 26 feet, so they need a broader, more specialized type of insurance. Marine-specific insurance companies can provide you with more coverage features and expertise, making them ideal for insuring a yacht, trawler, fishing boat, or other pleasurecraft.

Yachts tend to cost more than other recreational vehicles, travel farther than smaller vessels, and are at greater risk of damage when on the water and in storage. As such, they require more protective coverage than smaller boats. In the event of an accident or total loss, yacht insurance allows you to repair or replace your large watercraft without having to pay out of pocket.

Yacht insurance policies can vary by company. Most protection plans provide coverage in the form of:

Hull Protection

Cargo insurance, protection & indemnity.

“There’s no question that you want and need to have hull coverage,” says Kemp. “That’s the physical coverage of the boat itself.”

Depending on the vessel you own, there are various types of hull insurance you can choose from. Yachts, fishing boats, expedition cruisers, and passenger vessels are all eligible for different policies and coverage offers. If you’re a yacht owner, hull protection can safeguard you from any loss or damage involving your vessel.

Coverage on the hull is an agreed value policy, meaning the insurer and owner have agreed on the boat’s worth and stated it in the policy. Whatever value you decide on is the maximum amount that the insurer will pay in the event of a total loss. It can also cover any items on the vessel, including furniture.

All Risk vs. Named Perils

Since your yacht can fall prey to so many different types of damages, it’s a good idea to obtain an all-risk hull policy. While a named-perils policy is less expensive, it is also more limited. Keep in mind, however, that all risk does not necessarily mean “all loss.” Damages must be unexpected and accidental. With an all-risk policy, you may have to prove that the loss or damage was unintentional.

Policy Limits

Hull insurance can include a series of other policies that may limit the amount of coverage you receive. It’s important to talk with your insurer about how, where, and when you plan to use your watercraft so they can find the right hull policy to suit your lifestyle. Some limits may include:

- Time Policy: A time policy is a marine insurance policy that’s only valid for a specific time period, usually a year.

- Lay-Up Option: Insurers may limit coverage to a certain time of year, typically during the spring and summer, and require the boat to be stored or “laid up” for the rest of the year.

- Voyage Policy: As the name suggests, this type of policy insures your vessel for a single, specific voyage. It can also apply to both the hull of the vessel and the cargo on board.

- Navigational: Boats under 26 feet long are limited to inland and coastal waters, while larger vessels have policies defining more specific territories. Insurers may work with you to provide temporary coverage beyond these areas. However, hull policies often include navigational limits.

- Port Risk: Also known as a port policy, some insurance plans may confine coverage to times when your boat is at port and not on the open water. Your boat will have coverage for physical damage as well as liability.

Machinery Insurance

Marine insurance companies may bundle hull and machinery insurance to cover all essential machinery or mechanical equipment aboard the vessel. In the case of operational damage, an insurance company requires you to have a qualified marine surveyor assess the damage and determine whether the machinery needs repaired or replaced.

An insurer compensates you for claims on damaged machinery upon the surveyor’s approval. Policies like these typically cover equipment that generates power to move the boat and control electrical systems, including generators and engines, along with other machines that affect lighting and temperature control.

Sue & Labor Expenses

Hull policies have a “Sue and Labor” clause that requires boaters to protect their damaged property from further loss. Once you take steps to safeguard your boat, this part of the policy states that the insurer will reimburse you for any expenses you incurred in the process if the cost is greater than or equal to the value of the vessel. Essentially, the Sue and Labor clause covers the cost of salvaging your insured vessel.

Marine cargo insurance often applies to large commercial vessels, so you may not need it if you own a PWC or pleasurecraft. However, you may want to consider taking out ocean marine insurance for cargo if you operate a small business and use your personal watercraft to ship merchandise.

Hull & Personal Effects

Your marine insurance broker can help you choose policies that work best for your boating needs. If you frequently host parties and get-togethers on your boat, you can ask about modifying your hull policy to include insurance for personal effects. This addition would cover the cost of replacing expensive personal belongings, such as cameras, smartphones, and entertainment systems.

Also called P&I, Protection and Indemnity insurance is liability coverage for your watercraft. P&I policies offer additional protection to safeguard the insured from bodily injury, property damage resulting from the use or ownership of the insured vessel, and other risks that may or may not fall under your hull policy.

In addition to your hull policy, liability insurance is one of the most important types of coverage to have on any maritime vessel. P&I offers financial and legal protection from accidents resulting in property damage or casualties. Most types of P&I insurance offer payments for loss of life, injury, illness, hospital, and medical expenses.

What P&I Covers

P&I coverage varies across different policies and insurers, so you’ll need to speak with your broker to figure out how much coverage you need. Most Protection & Indemnity policies offer protection against:

- Injuries or death suffered by persons on shore caused by the negligence of crew

- Loss of life, injury, and sickness of the crew, passengers, and third parties

- Damage caused by the vessel to fixed floating objects or shore-side structures, including docks, piers, jetties, bridges, etc.

- Costs to remove the wreckage of the insured vessel

- Damage to other vessels (collision liability may already be part of your hull policy)

- Expenses incurred in related lawsuits, plus defense provided in Admiralty Court

- Pollution done to the environment (typically bought as a separate pollution liability insurance)

P&I Clubs

Although P&I is often part of your overall insurance policy, some boat owners may opt to be members of a P&I club. A P&I club is a member-supported mutual fund that provides protective coverage for all members. Each club has rules dictating the scope of coverage they provide.

Getting Coverage

Get a qualified insurer.

Whether you’re buying your first boat or your third, working with an experienced marine insurance broker to assess your needs and get the right coverage is crucial. Finance and Insurance professionals like Christopher Kemp at Yachting Solutions are also helpful in making sure your investment has adequate protection.

Global Marine Insurance

Yachting Solutions works closely with Global Marine Insurance, a marine insurance company specializing in yachts, mega yachts, boats, and marine businesses. “They’ve got a variety of different companies they use for underwriting and writing policies. So, they’re able to offer some extremely aggressive premiums and amazing coverage,” Kemp says.

Global Marine Insurance has been in the industry for more than 75 years. They offer regional boating guides and customized yacht insurance across all 50 states, both in the Pacific and Atlantic Oceans and inland waters. Global Marine Insurance has office locations in Michigan, Washington, California, and Florida.

Free Quote with Yachting Solutions

At Yachting Solutions, we have finance and insurance professionals on staff to help you with all your boat buying needs, including the protection of your watercraft. We offer a complimentary boat insurance quote free of charge. Click here to access the application and discover policies best suited for your budget and your lifestyle.

Related posts

Comparing Indoor vs. Outdoor Storage

Preparing Your Boat for Storage

What to Look for in a Storage Facility

Pleasure Craft Insurance the broker friendly way

Quick quotes and a simpler way to access policies means happier clients.

Accurate quotes faster

Boat insurance. the better way..

Navigate smooth waters with our boat insurance platform, designed for brokers.

Modern software tools designed for brokers make it simple to get quotes and access policies

Submit and issue a new policy - all online for qualifying risks

Get guidance from Coast's pleasure craft insurance specialists when you need it

Tailored for a wide variety of vessel classes based on our comprehensive All Risk Agreed Value forms

One policy, one bill - plus receive multi-vessel discounts on qualifying vessel classes

Discounts available for qualified experience, claims-free, boating education and more

We've got you covered.

Coast Underwriters has been Canada's quality choice for Pleasure Craft insurance for over 75 years. Our range of tailored products can be accessed from a digital platform custom-built for brokers.

Coast Underwriters Pleasure Craft

You have been redirected from Yachtworks.ca to Coast Underwriter's new Pleasure Craft insurance site.

The new Pleasure Craft insurance system has been designed specifically for brokers and offers a better solution for quick quotes, accessing policy info and communicating with Coast underwriters.

You will need an account in this new Pleasure Craft system to login .

If you do not have an account yet - you can apply for one.

Once you have applied , a Coast representative will review your new broker account submission and follow up.

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.

Log in to access admitted lines for workers compensation, business owners, miscellaneous errors and omissions, accident medical, general liability, commercial property, farm property, and equine mortality.

Markel Online

Log in to access non-admitted lines for contract binding property & casualty, excess, and commercial pollution liability.

MAGIC Personal Lines portal

Log in to access personal lines products including marine, specialty personal property, powersports, bicycle, and event insurance.

Markel Surety

Log in to access Markel's surety products.

Yacht insurance

The marine insurance leader for over 45 years.

Find a Markel marine agent and get a free, no-obligation quote today.

If you love your yacht, you’ll love our insurance.

We’ve been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct advantages in coverage features, options, knowledge and experience.

Why do you need yacht insurance?

Whether you own a yacht or a houseboat, we understand it’s not a typical boat and shouldn’t be covered by a typical boat insurance policy. That’s where we come in—each Markel yacht insurance policy can be customized to fit your yacht, your needs, your budget and your style.

Still not sure?

Here’s a few of the potential advantages to insuring your yacht with us:.

More complete coverage than any other carrier at no additional cost.

Experienced yacht underwriters and marine claims specialists who provide prompt, responsive service.

Discounts and cost-effective coverage options to save you money.

Flexible payment options.

Save money by customizing your yacht insurance

Actual cash value coverage (ACV) Reduce your coverage to ACV, which factors in depreciation of your yacht should you have to file a claim.

Lay-up option We’ll discount your yacht insurance premium during the winter months when your yacht is not in use.

Higher deductibles If you can manage minor repairs to your boat on your own, selecting a higher deductible will reduce your premium.

Windstorm exclusion Live in an area that isn’t at risk for a hurricane? You may consider removing windstorm coverage from your policy.

Liability only Coverage in case you damage another yacht and/or person (doesn’t require a survey—even for older boats).

What we offer

We offer coverage for a variety of watercrafts over 26 feet in length, including:.

- Sport fishing boat

Our coverages can include:

- Coverage for your yacht

- Coverage for you

- Optional coverages

Hull and equipment insurance protection including:

- Protect and recover can cover reasonable costs incurred when trying to protect your yacht from further damage after an accident

- Consequential damage for non-wood yachts–normal wear and tear and deterioration is not typically covered under a yacht insurance policy. However, if your yacht suffers damage from fire, explosion, sinking or collision because of one of these conditions, you may be protected

- Ice and freezing damage coverage if you contracted with a commercial marina or repair facility

- Agreed value for total loss

- Deductible waived on most total losses

- No depreciation on most partial losses

- Automatic tender coverage

Windstorm extra expense If there is a named storm, watch or warning, we will share the expense with you to help protect your yacht before the storm makes landfall.

Personal effects coverage For all the “extras” you physically bring onto your yacht. (i.e., smart phone, camera, etc.)

Emergency towing and assistance Coverage for towing expenses if your yacht happens to get stuck in or out of the water, including the delivery of gas, oil and parts.

Rental reimbursement coverage Coverage for when your yacht is being repaired from a covered loss.

Uninsured boater Unfortunately, not all boaters on the water have insurance. This coverage helps protect you and your family members if you are injured in an accident caused by an uninsured boater. Coverage is automatically included if watercraft liability is purchased.

Pollution liability Pollution coverage helps protects you if you are held legally liable due to an oil pollution leak or spill.

Medical payments Coverage for injuries suffered during an accident on your yacht.

Paid crew (Jones Act) Protection for you if you are legally responsible for injuries to a paid captain or crew member while on your yacht.

Protection and indemnity Coverage in the event that you are responsible for injuries to another person, or damage to their boat or property. Wreck removal is included with purchase of hull coverage.

- Boat trailer coverage

- Boat lift and boat house coverage

- Fishing tournament reimbursement for fishing boats

- Fishing equipment protection

- Transit and storage coverage

- Trip coverage

- Trip interruption reimbursement

- Personal liability coverage if you live aboard your yacht

Frequently asked questions about yacht insurance

General questions.

How much coverage do I need? Each boat, person, location and situation is different. There isn't a good way to give a "ballpark" figure for how much coverage you need. It’s best to evaluate your comfortable level of risk when protecting your boat, assets and passengers. Your best option is to call our boat specialists at +1.800.236.2453 to discuss the best coverage for you.

Can I insure my yacht for liability only? Yes, we offer protection and indemnity (liability only) coverage to help protect you in case you are responsible for injuries to another person or damage to another boat or property. Many carriers do not offer liability-only policies for yachts, or if they do, require a survey. However, Markel’s protection and indemnity coverage does not require a survey, so you’re able to do what you love without worries out on the water.

Will my policy cover normal wear and tear of my yacht? Most insurance policies will not cover normal wear and tear of your yacht and the deterioration or the resulting damage. However, if your yacht is damaged from fire, explosion, sinking, collision or stranding, you may be protected under our consequential damage coverage.

Can I use my yacht for chartering? We know that sometimes yacht owners charter their yacht for sightseeing tours or even sport fishing to help offset some of the costs of owning a yacht. Markel offers an optional limited charter coverage for these situations provided the captain of the watercraft has a minimum of 2 years loss-free experience of yachting. Additional restrictions may apply.

I live on my yacht. Am I covered? Markel provides live aboard coverage. Be sure to disclose that you live aboard to your agent.

My yacht is in a corporation's name. Can I still insure it with Markel? Our yacht insurance policy can cover corporately titled boats for both personal use and client entertainment. We do require all corporately titled boats designate a designee of the watercraft. Contact your agent to learn more.

Do I need to insure my yacht in the winter? It may seem that since you don't use your yacht in the winter you don't need to insure it. This is a risky way of looking at insurance and one that we have seen cost far too many people far too much money. Your yacht is at risk for damages at all times of the year, not only when it's on the water. For example, if your yacht is placed in storage for the winter and is damaged, you will not have any assistance in paying for those repairs without an active insurance policy.

Do you cover unique boats? We offer coverage for various kinds of boats that other insurers may shy away from, including: high performance boats, airboats, hovercraft, etc. Not sure if your watercraft will be covered? Give us a call at +1.800.236.2453 to speak with one of our marine insurance specialists.

What kind of fishing equipment is covered? Your rods, reels and tackle are automatically covered under your personal effects coverage up to the limit purchased. If that coverage isn't sufficient, our fishing equipment coverage provides insurance protection at replacement cost. Please contact one of our marine insurance specialists at +1.800.236.2453 to find out more.

Claims questions

How do I file a claim? We understand that no one wants to file a claim. That's why we do everything we can to make the process as painless as possible. You can report your yacht insurance claim by calling our office at +1.800.236.2453 or submit your claim online and we'll take it from there.

How long will it take for my claim to be processed? We are committed to investigating, evaluating and resolving marine insurance claims in a timely manner.

Is there anything I can do to help speed up the claim process? Yes, you can help streamline the claims and settlement process and avoid delays by providing the following information when you file your claim:

- Policy number

- Date, time and location of loss or damage

- Description of loss or damage

- Digital photos (if possible)

- Phone number to reach you

Additional resources

Related articles.

From boat safety tips to breaking down yacht insurance, find the information, advice, and resources you’ll need all in one place.

Warrior Sailing

Markel is a proud supporter of Warrior Sailing, an organization dedicated to healing and strengthening the lives of veterans through sailing. Visit warriorsailing.org to learn about Warrior Sailing and how you can donate to the program so they can continue to help the lives of wounded veterans.

Related products

Specialized coverage designed specifically for boats 26 feet or less, such as pontoons, runabouts, fishing boats and more.

High performance boat

Insure your high performance watercraft with a high performing policy for all your specific needs.

Personal watercraft

Fit your budget and boating style with affordable and customizable coverage for your personal watercraft.

Key Largo, FL

Tavernier, fl, sister bay, wi, kewaunee, wi, our offices, opening hours, contact form submission.

We have placed cookies on your device to help make this website better.

You can use this tool to change your cookie settings. Otherwise, we’ll assume you’re OK to continue.

Some of the cookies we use opens in a new tab/window are essential for the site to work.

We also use some non-essential cookies to collect information for making reports and to help us improve the site. The cookies collect information in an anonymous form.

To control third party cookies, you can also adjust your browser settings opens in a new tab/window .

Get started today

Yacht Insurance

Let gallagher charter lakes navigate the insurance process for you..

Yachts are valuable assets worthy of the best insurance protection. And while yachts differ by construction, size and value they also differ in the way they are used and how they are navigated. Understanding the risks inherent with yacht ownership is critically important to being able to properly insure the yacht. That is why working with a Yacht Insurance Specialist is so important to procure the broadest protection available at the most affordable price. That is the definition of true value and that is what we are passionate about here at Charter Lakes. Our account executives will help you design a policy that precisely fits your needs. We have 24/7 claims service, so you will have support available when you need it in the unfortunate event that you have a mishap on the water.

Please note: Every yacht insurance policy is written differently and can vary greatly in the amount of coverage it provides. Charter Lakes represents the largest, most financially sound yacht insurance underwriters in the country. We understand the strengths and weaknesses of each underwriter’s policy form, including those of our competitors. Our Account Executives will help you find the right policy to precisely fit your needs and your budget.

Basic Yacht Policy Features Include:

- All Risk policy form written on an occurrence basis

- Physical Damage is written on an Agreed Value basis

- Protection and Indemnity Liability

- Pollution Liability

- Medical Payments

- Personal Property Coverage

- Uninsured Boaters Liability

- Towing and Emergency Assistance

Did you know that many yacht insurance policies specifically exclude loss caused by mechanical breakdown? That may not be surprising to you since your automobile policy excludes mechanical breakdown as well. However, we sell several policies that do not exclude mechanical breakdown loss. This could mean the difference between having a $ 50,000 engine failure covered or not.

The yacht Insurance marketplace can be challenging. Working with a Yacht Insurance Specialist is the best way to procure the broadest insurance protection at the most affordable price.

Putting our team behind you is a winning combination.

Yacht Insurance by GYW. Our international Super/Mega-Yacht insurance team is a dedicated group of specialists, equipped to help owners/corporations navigate their way through the multitude of customized insurance solutions available to cover the exposures linked to the operation of their Super/Mega-Yacht. We understand that arranging insurance for your Super-Mega Yacht demands levels of discretion and expertise, which are fundamental to our personalized service.

Our practical experience will guide you through the entire process of insurance and we are fully trained to respond to the more complex insurance needs of Super/Mega-Yacht owners, managers and captains.

We offer tailored risk advice and global, innovative insurance solutions. We have access to US, Lloyd’s and European insurance markets so we are uniquely positioned to offer exclusive, competitive yet fully comprehensive Super/Mega-Yacht insurance products to our discerning clients.

As well as market leading Super/Mega-Yacht coverage, we can offer dedicated personal accident coverage (including emergency medical expenses and search and rescue) providing peace of mind for both the owner and crew. If you plan to employ crew, you can also call upon our dedicated crew products, tailored to cover your liabilities as an employer and the crew’s accident and medical risks.

GYW’s Insurance Product Offerings Include:

- Hull & Machinery

- Kidnap & Ransom (K&R)

- Builder’s Risk

- Loss of Hire

- Fine Art & Personal Effects

- Mortgagee’s Interest

- Marine Cyber

- Subsea Equipment

- Guest and Crew Medical Expenses

- Personal Accident Cover

- Charterers’ Liability

- Trip Cancellation

Healthcare in Moscow

This guide was written prior to Russia's 2022 invasion of Ukraine and is therefore not reflective of the current situation. Travel to Russia is currently not advisable due to the area's volatile political situation.

Healthcare in Moscow is organised by the Moscow Health Department. While public healthcare facilities are available, most expats seek out private healthcare at international medical centres. Expats are advised to take out private medical insurance if it is not provided to them by their company.

Subsidised healthcare is provided to everyone living in the country, paid for by the state and the mandatory health insurance system. That said, professionals in the state system are likely to speak little to no English.

There are several private medical centres in Moscow where English is spoken and where the healthcare is on par with expat standards. These clinics are generally very expensive, so it is highly recommended that expats take out private medical insurance to cover medical costs in Moscow. Most insurance coverage plans will also include evacuation cover for emergencies or life-threatening situations.

Recommended hospitals in Moscow

Alliance medicale.

www.alliancemedicale.ru Address: Kutuzovsky Ave, 1/7

Intermed Center American Clinic

www.en.intac.ru Address: 4 Monetchikovsky Lane, 1/6, Building 3

International Clinic MEDSI

www.medsi.ru Address: 26 Prospekt Mira, Building 6

European Medical Center

www.emcmos.ru Address: 5 Spiridon'yevskiy Pereulok, Building 1

Further reading

►For more on the Russian healthcare system see our Healthcare in Russia page.

Expat Interviews " The standard is high, but health insurance is essential − both international and local cover tend to be adequate and similar for routine things." Read more about Stephen, a British expat, and his experience living in Moscow .

Are you an expat living in Moscow?

Expat Arrivals is looking for locals to contribute to this guide, and answer forum questions from others planning their move to Moscow. Please contact us if you'd like to contribute.

Expat Health Insurance

Cigna Global Health Insurance. 20% off premiums booked before 31st March Medical insurance specifically designed for expats. With Cigna, you won't have to rely on foreign public health care systems, which may not meet your needs. Cigna allows you to speak to a doctor on demand, for consultations or instant advice, wherever you are in the world. They also offer full cancer care across all levels of cover, and settle the cost of treatments directly with the provider. Get a quote from Cigna Global - 20% off

Aetna Aetna International, offering comprehensive global medical coverage, has a network of 1.3 million medical providers worldwide. You will have the flexibility to choose from six areas of coverage, including worldwide, multiple levels of benefits to choose from, plus various optional benefits to meet your needs. Get your free no-obligation quotes now!

Moving Internationally?

International Movers. Get Quotes. Compare Prices. Sirelo has a network of more than 500 international removal companies that can move your furniture and possessions to your new home. By filling in a form, you’ll get up to 5 quotes from recommended movers. This service is free of charge and will help you select an international moving company that suits your needs and budget. Get your free no-obligation quotes from select removal companies now!

Free Moving Quotes ReloAdvisor is an independent online quote service for international moves. They work with hundreds of qualified international moving and relocation companies to match your individual requirements. Get up to 5 free quotes from moving companies that match your needs. Get your free no-obligation quotes now!

Advertisement

Supported by

Companies Linked to Russian Ransomware Hide in Plain Sight

Cybersecurity experts tracing money paid by American businesses to Russian ransomware gangs found it led to one of Moscow’s most prestigious addresses.

- Share full article

By Andrew E. Kramer

MOSCOW — When cybersleuths traced the millions of dollars American companies, hospitals and city governments have paid to online extortionists in ransom money, they made a telling discovery: At least some of it passed through one of the most prestigious business addresses in Moscow.

The Biden administration has also zeroed in on the building, Federation Tower East, the tallest skyscraper in the Russian capital. The United States has targeted several companies in the tower as it seeks to penalize Russian ransomware gangs, which encrypt their victims’ digital data and then demand payments to unscramble it.

Those payments are typically made in cryptocurrencies, virtual currencies like Bitcoin, which the gangs then need to convert to standard currencies, like dollars, euros and rubles.

That this high-rise in Moscow’s financial district has emerged as an apparent hub of such money laundering has convinced many security experts that the Russian authorities tolerate ransomware operators. The targets are almost exclusively outside Russia, they point out, and in at least one case documented in a U.S. sanctions announcement, the suspect was assisting a Russian espionage agency.

“It says a lot,” said Dmitry Smilyanets, a threat intelligence expert with the Massachusetts-based cybersecurity firm Recorded Future. “Russian law enforcement usually has an answer: ‘There is no case open in Russian jurisdiction. There are no victims. How do you expect us to prosecute these honorable people?’”

Recorded Future has counted about 50 cryptocurrency exchanges in Moscow City, a financial district in the capital, that in its assessment are engaged in illicit activity. Other exchanges in the district are not suspected of accepting cryptocurrencies linked to crime.

Cybercrime is just one of many issues fueling tensions between Russia and the United States, along with the Russian military buildup near Ukraine and a recent migrant crisis on the Belarus-Polish border.

The Treasury Department has estimated that Americans have paid $1.6 billion in ransoms since 2011. One Russian ransomware strain, Ryuk, made an estimated $162 million last year encrypting the computer systems of American hospitals during the pandemic and demanding fees to release the data, according to Chainalysis, a company tracking cryptocurrency transactions.

The hospital attacks cast a spotlight on the rapidly expanding criminal industry of ransomware, which is based primarily in Russia. Criminal syndicates have become more efficient, and brazen, in what has become a conveyor-belt-like process of hacking, encrypting and then negotiating for ransom in cryptocurrencies, which can be owned anonymously.

At a summit meeting in June, President Biden pressed President Vladimir V. Putin of Russia to crack down on ransomware after a Russian gang, DarkSide, attacked a major gasoline pipeline on the East Coast, Colonial Pipeline , disrupting supplies and creating lines at gas stations.

American officials point to people like Maksim Yakubets, a skinny 34-year-old with a pompadour haircut whom the United States has identified as a kingpin of a major cybercrime operation calling itself Evil Corp. Cybersecurity analysts have linked his group to a series of ransomware attacks, including one last year targeting the National Rifle Association. A U.S. sanctions announcement accused Mr. Yakubets of also assisting Russia’s Federal Security Service, the main successor to the K.G.B.

But after the State Department announced a $5 million bounty for information leading to his arrest, Mr. Yakubets seemed only to flaunt his impunity in Russia: He was photographed driving in Moscow in a Lamborghini partially painted fluorescent yellow.

The cluster of suspected cryptocurrency exchanges in Federation Tower East, first reported last month by Bloomberg News, further illustrates how the Russian ransomware industry hides in plain sight.

The 97-floor, glass-and-steel high-rise resting on a bend in the Moscow River stands within sight of several government ministries in the financial district, including the Russian Ministry of Digital Development, Signals and Mass Communications .

Two of the Biden administration’s most forceful actions to date targeting ransomware are linked to the tower. In September, the Treasury Department imposed sanctions on a cryptocurrency exchange called Suex, which has offices on the 31st floor. It accused the company of laundering $160 million in illicit funds.

In an interview at the time, a founder of Suex, Vasily Zhabykin, denied any illegal activity.

And last month, Russian news media outlets reported that Dutch police, using a U.S. extradition warrant, had detained the owner, Denis Dubnikov, of another firm called EggChange, with an office on the 22nd floor. In a statement issued by one of his companies, Mr. Dubnikov denied any wrongdoing.

Ransomware is attractive to criminals, cybersecurity experts say, because the attacks take place mostly anonymously and online, minimizing the chances of getting caught. It has mushroomed into a sprawling, highly compartmentalized industry in Russia known to cybersecurity researchers as “ransomware as a service.”

The organizational structure mimics franchises, like McDonald’s or Hertz, that lower barriers to entry, allowing less sophisticated hackers to use established business practices to get into the business. Several high-level gangs develop software and promote fearsome-sounding brands, such as DarkSide or Maze, to intimidate businesses and other organizations that are targets. Other groups that are only loosely related hack into computer systems using the brand and franchised software.

The industry’s growth has been abetted by the rise of cryptocurrencies. That has made old-school money mules, who sometimes had to smuggle cash across borders, practically obsolete.

Laundering the cryptocurrency through exchanges is the final step, and also the most vulnerable, because criminals must exit the anonymous online world to appear at a physical location, where they trade Bitcoin for cash or deposit it in a bank.

The exchange offices are “the end of the Bitcoin and ransomware rainbow,” said Gurvais Grigg, a former F.B.I. agent who is a researcher with Chainalysis, the cryptocurrency tracking company.

The computer codes in virtual currencies allow transactions to be tracked from one user to another, even if the owners’ identities are anonymous, until the cryptocurrency reaches an exchange. There, in theory, records should link the cryptocurrency with a real person or company.

“They are really one of the key points in the whole ransomware strain,” Mr. Grigg said of the exchange offices. Ransomware gangs, he said, “want to make money. And until you cash it out, and you get it through an exchange at a cash-out point, you cannot spend it.”

It is at this point, cybersecurity experts say, that criminals should be identified and apprehended. But the Russian government has allowed the exchanges to flourish, saying that it only investigates cybercrime if Russian laws are violated. Regulations are a gray area in Russia, as elsewhere, in the nascent industry of cryptocurrency trading.

Russian cryptocurrency traders say the United States is imposing an unfair burden of due diligence on their companies, given the quickly evolving nature of regulations.

“The people who are real criminals, who create ransomware, and the people working in Moscow City are completely different people,” Sergei Mendeleyev, a founder of one trader based in Federation Tower East, Garantex, said in an interview. The Russian crypto exchanges, he said, were blamed for crimes they are unaware of.

Mr. Mendeleyev, who no longer works at the company, said American cryptocurrency tracking services provide data to non-Russian exchanges to help them avoid illicit transactions but have refused to work with Russian traders — in part because they suspect the traders might use the information to tip off criminals. That complicates the Russian companies’ efforts to root out illegal activity.

He conceded that not all Russian exchanges tried very hard. Some based in Moscow’s financial district were little more than an office, a safe full of cash and a computer, he said.

At least 15 cryptocurrency exchanges are based in Federation Tower East, according to a list of businesses in the building compiled by Yandex, a Russian mapping service.

In addition to Suex and EggChange, the companies targeted by the Biden administration, cyberresearchers and an international cryptocurrency exchange company have flagged two other building tenants that they suspect of illegal activity involving Bitcoin.

The building manager, Aeon Corp., did not respond to inquiries about the exchanges in its offices.

Like the banks and insurance companies they share space with, those firms are likely to have chosen the site for its status and its stringent building security, said Mr. Smilyanets, the researcher at Recorded Future.

“The Moscow City skyscrapers are very fancy,” he said. “They can post on Instagram with these beautiful sights, beautiful skyscrapers. It boosts their legitimacy.”

An earlier version of a picture caption with this article misstated the year in which Colonial Pipeline was hacked. It was 2021, not 2020.

How we handle corrections

Andrew E. Kramer is a reporter based in the Moscow bureau. He was part of a team that won the 2017 Pulitzer Prize in International Reporting for a series on Russia’s covert projection of power. More about Andrew E. Kramer

Inside the World of Cryptocurrencies

Pushed by a nonprofit with ties to the Trump administration, Arkansas became the first state to shield noisy cryptocurrency operators from unhappy neighbors. A furious backlash has some lawmakers considering a statewide ban .

Ben Armstrong, better known as BitBoy, was once the most popular cryptocurrency YouTuber in the world. Then his empire collapsed .

Federal judges are weighing whether digital currencies should be subject to the same rules as stocks and bonds. The outcome could shape crypto’s future in the United States .

New investment funds that hold Bitcoin have begun trading , and it might be tempting to invest in them. Should you ?

Since the FTX cryptocurrency exchange collapsed in 2023, a whole new market has emerged that hopes to profit from claims in the company’s bankruptcy .

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

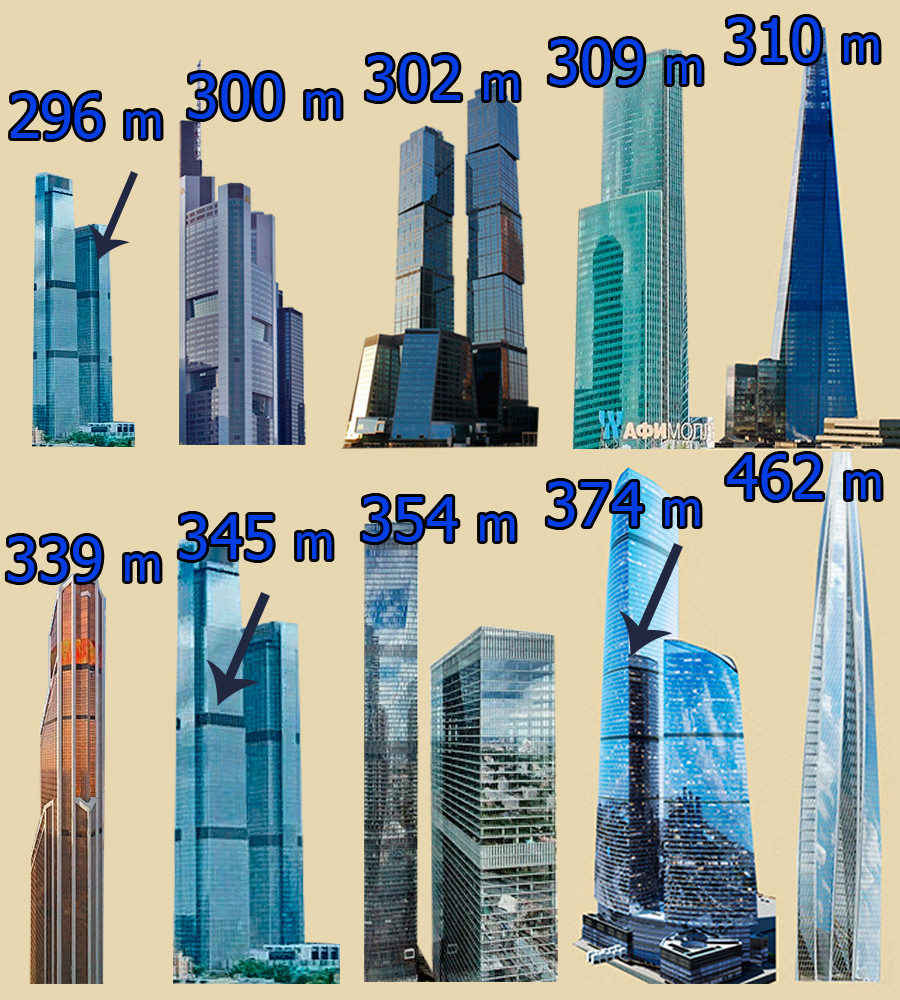

2. Domination of Europe's top-10 highest skyscrapers

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower

If all the building plans of Moscow-City were realized, the ‘Lakhta Center’ in St. Petersburg wouldn't have a chance to be Europe's highest skyscraper. Boris Tkhor, the architect who designed the concept of Moscow-City, had planned for the ‘Rossiya’ tower to be the tallest. In his project, it was a 600 meter tall golden cylindrical skyscraper ending with a spire that was inspired by traditional Russian bell towers. Then, the project was reinvented by famous British architect Sir Norman Foster. He had designed ‘Rossiya’ as a pyramid ending with a spire. The skyscraper itself would have been 612 meters tall, and the height including the spire would have reached 744,5 meters (for comparison, the ‘Burj Khalifa’ in Dubai, UAE, would have been just 83,5 meters taller). Unfortunately, the investors faced a lot of economic problems, due to the 2008 financial crisis, so the ‘Rossiya’ skyscraper was never built. A shopping mall and the ‘Neva Towers’ complex was constructed at its place in 2019.

4. Changed appearance of ‘Federation Tower’

In its first project, the ‘Federation Tower’ was designed to resemble a ship with a mast and two sails. The mast was to be represented by a tall glass spire with passages between the towers. It was planned to make a high-speed lift in it. The top of the spire was going to be turned into an observation deck. But the ship lost its mast in the middle of its construction. Experts at the Moscow-city Museum based in the ‘Imperia’ (“Empire”) tower say, that the construction of the spire was stopped, firstly, due to fire safety reasons and secondly, because it posed a threat to helicopter flights – the flickering glass of the spire could potentially blind the pilots. So, the half-built construction was disassembled. However, an observation deck was opened in the ‘Vostok’ tower.

5. Open windows of ‘Federation Tower’

We all know that the windows of the upper floors in different buildings don’t usually open. Experts say that it’s not actually for people’s safety. Falling from a big height is likely to be fatal in any building. The actual reason is the ventilation system. In a skyscraper, it’s managed with a mechanical system, and the building has its own climate. But in the ‘Zapad’ (“West”) tower of the ‘Federation Tower’ complex, the windows can open. The 62nd and last floor of the tower are taken up by a restaurant called ‘Sixty’. There, the windows are equipped with a special hydraulic system. They open for a short period of time accompanied by classical music, so the guests can take breathtaking photos of Moscow.

6. Broken glass units of ‘Federation Tower’

The guests of the ‘Sixty’ restaurant at the top of the ‘Zapad’ tower can be surprised to see cracked glass window panes. It is particularly strange, if we take into consideration the special type of this glass. It is extremely solid and can’t be broken once installed. For example, during experiments people threw all sorts of heavy items at the windows, but the glass wouldn’t break. The broken glass units of ‘Zapad’ were already damaged during shipment . As each of them is curved in its own way to make the tower’s curvature smooth, making a new set of window panes and bringing them to Russia was deemed too expensive . Moreover, the investors had financial problems (again, due to the 2008 financial crisis), so the ‘Vostok’ tower even stood unfinished for several years. Eventually, the cracked window panes were installed in their place.

7. The highest restaurant in Europe

‘Birds’, another restaurant in Moscow-City, is remarkable for its location. It was opened at the end of 2019 on the 84th floor of the ‘OKO’ complex’s southern tower. Guests at the restaurant can enjoy an amazing panoramic view at a height of 336 meters. On January 28, the experts of ‘Kniga Recordov Rossii’ (“Russian Records Book”) declared ‘Birds’ the highest restaurant in Europe, a step toward an application for a Guinness World Record.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- The evolution of Russia's No. 1 news program - from the USSR to now

- The Khodynka tragedy: A coronation ruined by a stampede

- ‘Moskvitch’: the triumph and sad end of a famous Moscow car plant (PHOTOS)

This website uses cookies. Click here to find out more.

IMAGES

VIDEO

COMMENTS

Welcome to the Yachtworks.ca on-line pleasure craft insurance quote. Please use your Broker Code to continue. Broker Code Sign in. Notice to Brokers. Our new Coast Pleasure Craft Quote & App portal will be replacing this quote site in March. Please visit www.pleasurecraftinsurance.com for more information and send in your new user broker app today.

Yacht Crew Insurance is your one-stop online shop for all your crew marine health insurance needs globally. We provide medical insurance for citizens of all countries of the world: US citizens traveling abroad, non-US citizens traveling worldwide, as well as for individuals and businesses within the U.S. Marine.

RSA - Pleasure Craft Insurance. At Royal & SunAlliance, Yachtworks is our suite of products designed for pleasure crafts. It includes: Simply P&I - a Value-Oriented Liability PolicySimply P&I offers the customer an alternative to the standard "All Risk" type policies for which they must purchase both physical damage and liability coverage.

Yacht Insurance. Protect your superior watercraft with superior protection from Chubb. Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon.

Yacht Insurance: An insurance policy that provides indemnity liability coverage on pleasure boats. Yacht insurance includes liability for bodily injury or damage to the property of others and ...