Popular search terms

Click each term for related articles

- COVID-19 Business awareness hub

- Climate Change

- Disputes Funding

- Insurance 2023 - the year ahead

- Training contract

Superyacht Fires and Insurance: Flammable or Fireproof

- Market Insight 18 October 2022 18 October 2022

UK & Europe

The superyacht sector has, in the last 36 months, been rocked by the extraordinary number of fires, including recent the devastating fire on board the 45m ISA m/y “ARIA SF” just a few weeks after her delivery. The ISA was a very public total loss. In this article our superyacht and insurance lawyers consider the legal and insurance issues superyacht owners and presumptive owners need to be thinking about to help ensure that they are protected should the unthinkable happen on board their superyacht afloat or in a shipyard.

During construction

The risk of fire on board a superyacht during its construction can be considerable, for example, whilst hot works are being carried out and during and after the installation of electrical systems and batteries.

Presumptive superyacht owners should should ask their specialist superyacht lawyers to explain what will happen should the worst happen. We set out below some key points to consider when negotiating any superyacht construction agreement.

Insurance during the build: The builder should be responsible for insuring the yacht during its construction continuing through until delivery to the owner. Presumptive superyacht owners should be certain that the yacht construction agreement clearly sets out the requirements of the builder’s insurance, including that it is:

A. placed with a first-class insurance company, that you can verify;

B. upon terms equivalent to/ not less extensive than the Institute Clauses for Builders' Risks (1/6/88) – which are the most widely used international form of insurance coverage for vessels under construction. Ask your lawyer to explain how these work; and

C. for a sum not less than the purchase price, plus the sum of any items supplied by the owner to the builder and installed on the yacht (commonly referred to as ‘owner’s supplies’).

Presumptive superyacht owners need to make sure that they are named as co-assured on the builder’s insurance policy and that they can request evidence of such insurances from the Builder on demand throughout the build and be part of any claim should the unthinkable happen. Your owner’s representatives need to be mindful that the yard is a safe place and that the yard are not doing anything which might void the policy. Although you will be relying on the policy you need to make provision should the policy not pay out in the event the policy becomes void or voidable. This becomes an issue where there is a partial loss during the build, perhaps smaller damage that can be easily repaired. The owner’s team would need to be involved in the decisions to continue the build following the fire and understand the cause.

Force Majeure: Yacht owners should be aware that most yacht construction agreements will include fire as a force majeure event , meaning that if the yacht’s construction is delayed because of fire, the builder will be entitled to postpone the delivery date to when the rebuild can happen, without being liable to pay liquidated damages to the buyer for delay, unless the fire was caused by the negligence or default of the Builder. How that will work against a typical clause which allows the presumptive owner to cancel the yacht construction agreement if the build drifts past a drop-dead date regardless of cause, needs to be contemplated.

Total loss or constructive total loss: If a yacht is destroyed by fire during its construction and deemed to be a total loss, actual or constructive then the owner should be entitled to a refund of all sums it has paid to the Builder on demand.

Although it would be prudent for presumptive superyacht owners to ensure that any payments they make to the builder are secured by way of refund guarantees, and that they can claim under such refund guarantees in the event that the builder fails to refund any amounts owed, the reality is that very few builders offer full refund guarantees. That fact elevates the importance of Builder’s All Risk Policy If you are lucky enough to get some kind of refund guarantee, they are only as good as the guarantor offering the guarantee. The refund guarantees should ideally be issued by a first-class international bank. Builders will usually be responsible for arranging the issuance and maintaining the refund guarantee as they will have longstanding relationships with banks in their jurisdiction. More often than not the price is factored into build price, however sometimes some presumptive owners want price transparency and want the cost of the refund guarantees separately invoiced. Builders will usually be responsible for arranging the issuance and maintaining the refund guarantee as they will have longstanding relationships with banks in their jurisdiction and the cost will be factored into the contract price of the yacht under the yacht construction agreement.

Sub-contractors: Given the technical nature and complexity of superyachts nowadays, Builders will inevitably need to sub-contract elements of the construction to specialist sub-contractors. However, owner’s team should ensure that the builder remains fully responsible for all work carried out by its chosen sub-contractors, and that such sub-contractors are adequately insured to enable the main superyacht construction.

After delivery

Following delivery of a new-build superyacht, or after the sale of a second-hand superyacht, risk transfers from the builder / seller to the owner. Whether the owner intends to use the yacht privately, or to charter the yacht out, the safety and insurance considerations are paramount:

Insurance: The precise extent of the cover available for damage caused by fires on superyachts will always depend on the specific wording of the relevant policy. However, the standard form wordings commonly adopted will invariably provide some form of cover for damage resulting from fires. Is that cover enough for you? For example, the Institute Yacht Clauses (1/11/85) specifically list fire as an insured peril. Fire would also be included within all risks cover provided in the American Yacht Form R12. What kind of procedures need to maintained onboard to ensure the insurances are not voided.

In addition to hull cover, both standard form wordings also provide forms of third-party liability or protection and indemnity insurance as well (although such cover is sometimes provided under a separate policy with, for example, a P&I club). That cover may then respond in circumstances where, for example, a fire spreads from the insured vessel to multiple other vessels. However, cover may vary depending on whether the insured vessel is in commission or laid up and out of commission. As such, careful consideration should always be given to the precise wording of the relevant policy.

Policies also commonly include warranties requiring yachts to be manned “at all times”. If a fire was to break out with no one onboard the insured vessel, there is a question as to whether and, if so, how, the policy would respond. Ultimately, this will depend on the specific wording of the warranty. Numerous decisions of the courts have demonstrated a flexible approach to the interpretation of “at all times” warranties which will depend on the natural and ordinary meaning of the warranty along with its commercial purpose and the practical context. For example, “Owner and/or Owner’s skipper on board and in charge at all times” was found to be primarily focused on protecting the vessel from navigational hazards and, therefore, did not preclude a claim for loss by fire whilst the crew were onshore with the vessel moored up in port. However, “fully crewed at all times” was construed more narrowly and was found to require at least one crew member on board the vessel 24 hours a day save for certain limited exceptions.

Following the Insurance Act 2015 coming into force in England, Insurers’ remedies for breaches of warranties (including “at all times” warranties) will turn on specific facts. If an insured is in breach of a warranty, the remedy will depend on the nature of the warranty. Many insurance policies are governed by English law and as a consequence the Insurance Act will be relevant, regardless of where your superyacht is.

If the relevant term defines the risk as a whole (for example, a requirement that a vessel is not used for commercial purposes or that a vessel shall be limited to specific navigable waters) cover is suspended for the period of breach and insurers are not on risk for loss during that time. Few warranties define the risk as a whole.

If the relevant term does not define the risk as a whole, it will be for the insured to establish that the breach did not increase the risk of the loss which occurred in the circumstances in which it occurred. So, for example, if a policy contains a warranty requiring the insured to maintain the onboard fire equipment, insurers will be able to rely on an insured’s failure to do so if the insured is unable to demonstrate that the breach did not cause the loss or contribute to the extent of the loss.

In either case, if the breach is remedied prior to loss, insurers will be on risk for that loss.

During a charter : Yacht owners should note that if a yacht is destroyed (i.e. an actual or constructive total loss) by fire during the course of a charter then, under the Mediterranean Yacht Brokers Assocation (MYBA) Charter Agreement terms , providing the fire was not caused by any act or default of the charterer, the owner would be required to refund the charter fee for the proportion of the charter period outstanding after the date when the loss occured. The charterer would also be entitled to recover from the owner its reasonable expenses of returning him/ her and his/ her guests to the place of re-delivery plus reasonable accomodation expenses incurred.

During refit/ repair/ warranty works

As with during the construction of a yacht, when a yacht returns to the builder’s yard or to another shipyard for refit, repair or warranty works, there are always potential fire risks, for example when carrying out hot works and electrical works as well as fires spreading from other yachts at the yard.

Insurance: Under the ICOMIA Standard Refit/ Repair Contract or the BIMCO REPAIRCON – common forms of standard contract used for repair and refit works on yachts – the owner is required to maintain hull and machinery and liability insurance in respect of the yacht and the owner’s representative, captain, crew and any other personnel for whom the owner is responsible during the period whilst works are being undertaken either at the contractor’s yard, or its subcontractors’ other facilities. The contractor is also required to maintain Ship Repairer’s Liability insurance, and the cost will be factored into the contract price under the refit/ repair contract.

Insurers will look to protect their position when it comes to risks of fire during refit / repair / maintenance works and, in particular, during hot work undertaken at shipyards. Whilst policies will often respond following such incidents, insurers may require additional premium for the increasedrisk associated with refit / repair / maintenance works. Insurers may also mandate the protection of their right to recover the indemnity paid from any responsible third party, however, it is now common practise for builders undertaking warranty work at their facilities to seek to protect themselves by asking owners and their insurers for a waiver of subrogation this is a clause which prevents the owner and its insurers from pursuing the yard in the event of a loss. Because causes like this remove the owners insurers right of recourse against the yard should (should the owners policy payout) such waivers should never be signed without the insurer's prior approval. Occasionally, the waiver of subrogation is subject to a cap. Repair yards also often seek waivers in respect of any liability for repair or maintenance work in excess of the limits of liability in the in the yards Ship Repairers Liability policy.

Further policies often include requirements for the insured to: (a) give insurers advance notice of schedule refit, repair or hot work; (b) ensure that the shipyard (or the relevant contractors) have operative liability insurance up to a particular value; and/or (c) as already discussed,ensure that no contractual exclusions, limitations of liability and/or waivers of subrogation have been agreed with the shipyard (or the relevant contractor).

Ultimately, insurers will often look for additional protection, whether by requiring additional premium or otherwise, to account for the additional risk associated with refit / repair / maintenance works.

Giovanna Cabbia

Max Braslavsky

- Yachts & Superyachts

Stay up to date with Clyde & Co

Sign up to receive email updates straight to your inbox!

Maritime Response

Restructuring, comprehensively yachts - hfw yachting industry briefing, december 2023, with 2023 drawing to a close, it has been another busy year for hfw’s yacht team and we are delighted to present the latest edition of comprehensively yachts, which you will find packed with topical comment and analysis..

Twenty one months since the invasion of Ukraine, the yachting industry, having been hard hit by the economic impact of Russian sanctions, has largely settled down and found new business to replace that lost or turned away. However, the risk of an inadvertent sanctions breach remains for those not taking care when onboarding new clients and accordingly we start with a look at the current sanctions landscape from our market leading sanctions team, together with a round-up of some of the high profile ongoing legal challenges.

Next, our marine insurance specialists consider whether the widely used American Yacht Form R12 is still fit for purpose or whether the time is right for the marine insurance industry to move on to a bespoke wording better suited to English law and the practices of both the London insurance market and the modern yachting industry.

The possibility of anonymously enjoying beautiful places in the company of your friends and family from the privacy of your yacht is key to the allure of yachting. However, with AIS technology enabling everyone with a smart phone to know your yacht’s every move, the temptation to turn off a yacht’s AIS transmission and “go dark” is real. Our admiralty team explore the law behind the transmission and how, if at all, you might achieve an ex-directory status.

Our Paris office reports on a recent land-mark conviction of the captain of a 26 meter yacht by the Maritime Court of Marseille following his repeated anchoring in protected posidonia meadows and the threat such conviction has for the wider yachting industry.

Finally, we round out this edition with a long read on Cyber Security, the increasing regulation around it and the growing need to take it seriously.

We hope you enjoy this edition and please do keep in touch. If there is anything you would like us to discuss in forthcoming editions, please do let us know.

William MacLachlan Partner, London

Sanctions Update

As sanctions measures targeted at russia expand and evolve around the world, yachting industry suppliers and service providers remain heavily exposed to the risk of a breach. all such businesses should continue to carry out thorough due diligence on the yachts they service as well as their registered owners and ultimate beneficial owners, to determine whether they are dealing with either a sanctioned person or a person who falls within the wider category of persons connected with russia..

We have seen a recent focus in the UK on the concepts of ownership and control, with indications that the English Courts will construe UK legislation in a way which potentially increases the impact of UK sanctions measures. The US continues to take steps to enforce its sanctions, and we are seeing the US and other authorities look carefully at the measures which might be adopted to move beyond the temporary freezing of assets, towards the permanent requisition and seizure of such assets. The EU is actively considering its 12th package of measures against Russia, which is expected to be adopted before the end of 2023.

There have of course been several high-profile actions relating to yachts with a Russian connection.

In the UK, PHI (a yacht owned by Russian property developer Sergey Naumenko) is still being detained by UK authorities after a failed challenge against their decision to seize the yacht. Naumenko’s attempt to argue that a lack of political connections rendered the seizure disproportionate failed in the UK’s High Court, which found that the UK Government had the right to seize the yacht on the basis that it was owned by a person connected with Russia. The Court further found that a Russian-owned vessel does not need to be owned by a sanctioned person or a person connected with Vladimir Putin in order to be lawfully seized in the UK. We are likely to return to the PHI in the new year, as we understand that the case has been appealed to the Court of Appeal.

In the US, matters related to the seizure of the yacht AMADEA continue, with Eduard Khudainatov, a Russian businessman, filing a claim on 28 November 2023 before the US District Court arguing that he “is and has always been the ultimate beneficial owner of” the AMADEA and challenging the US Government’s seizure and forfeiture of the yacht, which had been based on their belief that the yacht is owned by Suleiman Kerimov, who is under US sanctions.

The proposed sale of ALFA NERO to Google CEO Eric Schmidt has fallen through after Schmidt withdrew his bid. Authorities in Antigua and Barbuda had seized the yacht, claiming it to be owned by sanctioned Russian billionaire Andrey Guryev. However, Mr Guryev’s daughter has claimed to be the sole beneficiary of the trust that owns the yacht and, thus that she is the ultimate beneficial owner of the yacht and not Mr Guryev. Her appeal against the decision to sell the ALFA NERO has been dismissed and a corresponding injunction application has been refused. The Antiguan authorities still intend to auction off the yacht and maintain that it has been validly seized.

Elsewhere, the NORD, a yacht owned by Alexey Mordashov, continues to attract attention as it circumnavigates the world whilst keeping out of reach of western sanctions. In October 2023, it was spotted in Hong Kong before then proceeding to Cape Town.

Daniel Martin Partner, London

Stephen Green Associate, London

R12 Yacht Wording: Time for Something New?

As we reach the end of the year, many yacht owners and managers will be starting to think about insurance renewals. for many years, the majority of large yachts have been insured either on the basis of the american yacht form r12 or the london institute time clauses hulls. the latter is aimed at commercial shipping and has to be heavily adapted for the yacht market, but it does have the advantage of being well used and understood in the marine insurance market..

The R12 wording is popular due to it being an all risks policy and because it seeks to address some of the unique characteristics of running and managing large yachts, as opposed to commercial ships. However, it has a number of features which, at best, are hard to understand and, at worst, are seriously problematic for both insurers and assureds. Throughout it is drafted in the tenor and from the perspective of US law and practice, with concepts and approaches often not found in English Law. For example:

- There are references to the need to file a “sworn proof of loss” as a requirement for any claim being brought against the insurer.

- The same clause goes on to require all evidence in support of that loss to be provided within 90 days; something that will often be impossible to achieve.

- The wording refers to “examination under oath” , a concept that is not readily understood under English law.

- In section F there is a long clause entitled “service of suit” which makes express reference to the service of legal proceeds in the USA.

The proceeding section E deals directly with US federal longshoremen’s cover, which is unlikely to be of relevance to the majority of larger yachts.

There are other places where the wording does not readily integrate with other London market standard wordings, for example around the war exclusion, the treatment of deductibles, the return of premium and cancellations. It also contains a very short time limit of 1 year for bringing claims (though this is often amended to 2 years by agreement). Even where amended, this remains a very short time period and outside of standard market practice in the marine sector.

The are positive elements to the wording. From an assured’s point of view, the “no waiver” in the sue & labour clause is useful and would likely preclude an insurer from arguing that the assured had taken steps which were contrary to a notice of abandonment in the event of a potential constructive total loss. It also seeks to deal with launches and tenders head on and actively include them within the scope of the insurance.

However, in the round we consider that the market would welcome a bespoke yacht wording for property insurance. The yacht market has moved on considerably since the R12 entered common use, with ever increasing values, complexities and liabilities. A modern wording which reflects current market practice and the requirements of sophisticated yacht owners would only be a positive development.

Alex Kemp Partner, London

Jenny Salmon Legal Director, London

Is complete anonymity a Holy Grail for yacht owners?

There are many reasons why a yacht owner might want to make their yacht “ex-directory”. for example, to preserve the identity of the yacht in circumstances where the owner and/or his guests may be of interest to the media or where it is operating in a hostile environment. such status would no doubt be very popular if it was achievable. as always, however, there is a fine line to tread between ensuring anonymity and complying with national and international rules and regulations and every yacht owner and captain must consider the position carefully..

The starting position under SOLAS 1 Chapter V, Regulation 19.2.4, is that “all ships” of 300gt and upwards, engaged in international voyages must have an automatic identification system (AIS) enabled. There are nuances when it comes to the application of these rules to yachts, but most large yachts carry AIS transponders and receivers and use them, whether mandatory or not.

A vessel’s AIS transponder operates using VHF frequency radio waves, in the same way as a VHF radio and has about the same range as a VHF radio. Vessels within range of an AIS transponder should be able to pick up its AIS transmissions on their AIS receivers. In addition, a global network of base stations and satellites also pick up AIS transmissions. Around the UK alone, there are over 60 base stations receiving AIS data from passing vessels.

The AIS databases source data from shore stations, satellites and even other vessels. Certain companies, such as MadeSmart, maintain their own database and harvest AIS data from vessels fitted with their fleet tracking equipment. As the vessels fitted with fleet tracking equipment circumnavigate the world, they capture and upload AIS data from passing AIS transponders. The databases then further supplement this data by purchasing additional data from each other and other sources. Service providers such as Marine Traffic and Lloyds’ List purchase the compiled data and use it in their products.

For a vessel for which maintaining an AIS transmission is mandatory, turning off its AIS transmission is going to land that vessel’s owner in trouble with the law unless it is able to rely on one of the available exceptions. The IMO guidelines (SOLAS Resolution A.1106(29)) 2 require a vessel’s AIS to be in operation whenever underway or anchored. The only exception to this rule is when:

- the vessel is in imminent danger;

- the vessel’s captain is certain that maintaining the signal broadcast will compromise its safety and security. In such case, he/she must record the incident in the unit’s logbook and file a report to the competent authority, including a valid reason why he/she has decided to switch the AIS off, as well as the other measures taken; or

- the “silent mode” is operated in dangerous waters (for example, the suspected presence of armed pirates). However, this should be temporary and the AIS should be switched back on as soon as the threat is no longer considered imminent.

A desire to remain anonymous because you don’t want the press to be able to track you does not fall into any of the exceptions set out above. Further, the general presumption from the competent authorities, banks, insurers and others is that if a vessel is operating “dark”, i.e. with its AIS switched off, then it may well be participating in illegal activities. This may ultimately draw more attention to the vessel than leaving the AIS turned on.

In most cases, therefore, you cannot lawfully turn off your AIS transmission. So how else might an “ex-directory” status be achieved?

Some have suggested blocking individual websites from receiving the data or manipulating it in some way to hide the vessel’s identity. However, blocking or tampering with AIS data is illegal. SOLAS V/34-1 states: “The owner, the charterer, the company operating the ship as defined in Regulation IX/1, or any other person shall not prevent or restrict the master of the ship from taking or executing any decision which, in the master’s professional judgement, is necessary for safety of life at sea and protection of the marine environment”. So, if a reasonably prudent master considers AIS necessary for the safety of the vessel (which they should of course do), blocking or tampering with the signal is likely out of the question.

It might be possible to enter into an agreement with each of the individual companies making AIS data available to the public not to publish the AIS data about a particular yacht or yachts. Whilst in theory this would be possible, the service providers will expect something in return. Further, given the plethora of sites publishing AIS data it will be difficult to reach agreement with all and, even if you do, more may emerge.

Tom Walters Partner, London

Mark Thompson Senior Master Mariner, London

France steps up its defence of posidonia meadows and its environment

As previously reported in this publication, since october 2020, france has banned the anchoring of yachts over 24 meters in certain areas, mainly on the côte d’azur and corsica, in order to protect the vital posidonia grass meadows. the code des transports sets out severe penalties for those who breach these anchorage regulations. such penalties range from a temporary or permanent ban from sailing from french ports and in french territorial waters up to a year’s imprisonment and a eur 150,000 fine..

In an unprecedented move, on 20 October 2023, the Maritime Court of Marseille handed down the first judgment regarding breaches of these regulations. In doing so, it convicted the captain of a 26-meter yacht for having, on three occasions in 2021 and 2022, anchored his yacht in prohibited areas offshore Cannes and Saint-Tropez. The captain was fined EUR 20,000 and banned from sailing in French territorial waters for one year.

As was emphasized by the various environmental associations which joined the proceedings as plaintiffs, the permanent or temporary ban on sailing from French ports and in French territorial waters is considered a particularly effective sanction when it comes to deterring other yacht captains from committing the same offences.

The Court also ruled that the captain’s actions had caused “significant damage to ecosystems” and ordered him to pay compensation for the “ecological damage” caused by these actions. To estimate the economic value of the damage, the Maritime Court requested the assistance of the Environmental Unit of the Court of Marseille. This point will be debated at a further hearing set for 26 January 2024.

The regeneration of posidonia meadows is a slow process, which requires significant human intervention (such as replanting by the Water Agency, a French public body currently engaged in a project to protect posidonia meadows). One of the environmental associations involved has estimated the damage caused by the captain’s actions to amount to nearly EUR 60,000.

Although damage to the environment is a fairly new concept in French law, since it was introduced to the French Civil Code only in 2016, French judges now regularly apply it and are willing to admit claims made by local communities and environmental associations in respect of it. In a previous decision of 6 March 2020, concerning illegal fishing in the National Park of the Calanques (a protected area), the Criminal Court of Marseilles ordered the defendants to pay EUR 350,000 in damages, to be allocated in its entirety to repairing the damage caused by their actions to the National Park’s ecosystem.

The judgment by the Maritime Court of Marseille is likely to be the first in a long series of such judgments and it is to be expected that sanctions will become harsher as time goes by and the consequences of illegally anchoring in posidonia meadows and the costs of their restoration becomes clearer. Yacht owners and their captains should take seriously the threat this judgment posses to them.

Hélène de Ferrières Senior associate, Paris

Cyber Security, Take it Seriously!

Cyber-attacks continue to dominate the news, with recent political tensions and war highlighting society’s reliance on, and the vulnerability of, computers and the connectivity which they provide. whilst some of the most serious attacks last year involved the loss of very significant sums of money by their victims, 3 it is becoming increasingly clear that cyber-attacks can, in addition to causing financial and reputational damage, also potentially cause a threat to life and limb, property and the environment 4 ..

In January 2023, about 1,000 ships were affected by a ransomware attack when the international classification society, DNV, was attacked and forced to shut down its IT servers and ShipManager System. DNV has since published its report on the attack entitled “Maritime Cyber Priority 2023,” which includes results from a survey of 801 maritime professionals covering the perceived threats, preparedness and challenges related to cyber security. 5 More than 60% of those surveyed expect cyber-attacks to cause ship collisions and groundings within the next few years, and 76% of those surveyed believe a cyber incident is likely to force the closure of a strategic waterway.

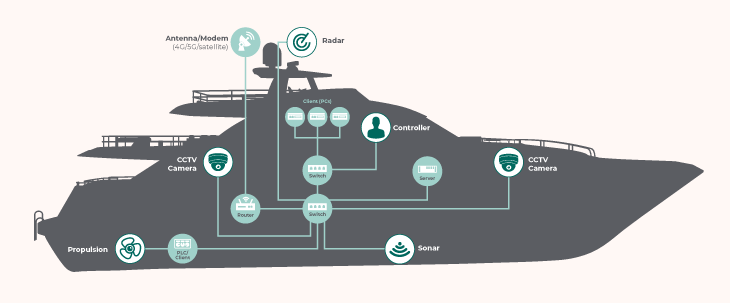

The yachting industry must adopt a robust approach to cyber-security. Such an approach should be built in from the very beginning of the design process and maintained throughout a yacht’s life. Cyber-attacks on yachts typically threaten privacy and reputation,and focus on the theft of financial and personal data as well as financial crime. Typically, they are launched through ransomware or malware attacks on the yacht itself or the devices of its guests and/or crew.

However, they can go further. Once a system has been attacked and breached, threat actors can go on to do anything from stealing personal data to gaining and maintaining full access to a device, potentially jeopardising the safety of both the individual and the operational integrity of the yacht.

We have previously reported on the update to the International Safety Management Code (the ISM ) requiring all commercially operated vessels to address cyber security in their Safety Management System (the SMS ) in accordance with MSC-FAL.1-Circ 3 and IMO Resolution MSC.428(98). The resolution also encouraged Flag States to ensure that cyber risks are appropriately addressed in SMS no later than the first annual verification of the company’s Document of Compliance (the DOC ) after 1 January 2021.

In response to this development, the International Association of Classification Societies ( IACS ) introduced new Unified Requirements ( URs ) on cyber safety with the aim of developing a vessel’s resilience and helping ship owners strengthen their cyber security arrangements 6 .

URs E26 and E27 respectively deal with the cyber resilience of ships and the cyber resilience of onboard systems and equipment. They consolidate the requirements for cyber safety onboard ships and will be implemented by the eleven IACS member societies on ships contracted for construction on or after the 1 July 2024 7 . These URs build on IMO Resolution MSC.429(98)/Rev.1 and the guidance in MSC-FAL.1/Circ.3.

The URs have been categorised as “mandatory” and “non-mandatory” depending on vessel type and size. E26 and E27 will apply to privately registered passenger yachts carrying more than 12 passengers and commercial yachts 8 .

It is important to underline that the URs introduce new standards for the cyber resilience of not only the systems and equipment onboard but for the vessel as a whole. They will naturally increase the responsibilities of shipyards and manufacturers, who will now be required to check the integrity of a vessel’s systems before they are installed. This new layer of checks may prove time-consuming and could ultimately delay newbuild projects if not properly considered in the production schedule. Many of the checks themselves will be highly technical in nature, and thus require a certain level of expertise from the personnel engaged in the process 9 and it will be for the classification society overseeing the construction to ensure the vendor systems comply with the URs 10 and duly certify themselves. Whether the yacht building industry has sufficient suitably qualified personnel to carry out this work remains to be seen.

After 1 July 2024, the owners and managers of any yacht to which the URs apply must ensure that the yacht’s ISM deals with the mitigation of cyber risks and that they have established safeguards against all risks to ships, personnel, and the environment. The new URs will complement existing UR E22, which relates to the onboard use and application of computer-based systems. Whilst the new URs will not apply to all yachts, it would be prudent for all yachts to take them seriously and do what they can to comply.

UR E26: The vessel’s cyber-resilience as a collective entity 11

UR E26 is to be uniformly implemented by IACS members and its purpose is to make vessels cyber resilient 12 . The intention is for this to be achieved through “the secure integration of both Operational Technology ( OT ) and Information Technology ( IT ) equipment into the vessel’s network during the design, construction, commissioning, and operational life of the ship” 13 . The following stakeholders will be required to comply with the requirements:

- Shipowner Company

- Ship Designers and Shipyards

- System Integrators

- Classification Societies

Further, UR E26 covers the five functional elements summarised in the table attached at the end of this article 14 . Each of these five elements introduces its own requirements. These are highly technical in nature and are to be addressed by the suppliers and shipyards. The appendix to UR E27 sets out a useful summary of the relevant phases, actions and documents involved. There are identified as:

- Construction

- Commissioning

The “Shipowner Company” is engaged only in the Operation and Survey phases. Interestingly, the obligations of the shipowner are merely to “maintain” or “make available.”, as per the Appendix’s wording. This means that shipowners have to make sure documents are kept up to date and made available if needed. By contrast, the role of the classification society, supplier, shipyard and system integrator in the process is considerably more demanding.

That being said, owners should still stay alert and are encouraged to actively participate in the process, especially when it comes to agreeing vessel specifications. During negotiations and other relevant arrangements with shipyards and suppliers, owners should ensure the requirements of UR E26 are met. This is not only to ensure compliance with UR E26 but also to mitigate the risk of the classification society refusing to sign-off a vessel. Further, after a newbuilt vessel is delivered, owners will have to make sure that software and systems onboard as well as incident response plans are suitably maintained.

UR E27: cyber-resilience of onboard systems and equipment

This UR establishes another set of minimum requirements which are applicable to Computer Based Systems 15 ( CBS ) referred to in UR E26.

Pursuant to UR E27, “a System can consist of group of hardware and software enabling safe, secure and reliable operation of a process” 16 . UR E27 goes on to specify the security capabilities necessary for compliance with this UR, which are required for all CBSs.

The documentation relevant to these systems shall be submitted to the classification society, for its review and approval.

“Equipment” could refer to:

- Network devices (i.e. routers, managed switches) – e.g. a modem which connects the vessel to the internet via a 4G, 5G or satellite connection. A router allows the local network to share a single internet connection and creates a subnet by assigning IP addresses or names to all the other devices on the network. A switch physically directs data to devises on the network.

- Security devices (i.e. firewall, Intrusion Prevention System).

- Computers (i.e. workstation, servers) e.g. monitors from which you can navigate the yacht or control the vessel.

- Automation devices (i.e. Programmable Logic Controllers).

- Virtual machine cloud-hosted 17 .

Legal and practical considerations

Installing and maintaining a robust cyber security system covering all of the systems and equipment onboard, as well as the vessel as a whole, is essential. Any vessel contracted for construction after the 1 July 2024 must be fit from a cyber-security perspective if it is to be signed off by the relevant classification society.

Stakeholders should consider the following:

- If Class approval is not obtained, this could trigger a domino effect with serious consequences. For instance, the vessel’s seaworthiness could come into question. This could not just create problems from an insurance perspective, with insurers being reluctant to provide cover, but also lead to claims being made against owners. These could be brought by, among others, charterers or guests or insurers.

- Insufficient cyber-security measures could pose a threat to the availability of insurance cover. Potential exposure of Hull & Machinery and Protection & Indemnity insurers to liability in the event of an incident could mean that there would be no cover or security provided. Inadequate cyber-security systems onboard could also lead insurers to demand that a vessel is brought up to the specifications necessary for cover to be available, after construction is completed.

- More sophisticated IT systems onboard could also impact policy wordings. The latter could be updated, especially given the requirements introduced by the URs are “minimum” and therefore insurance providers could demand higher thresholds to be met.

- If cyber risks are not appropriately addressed in the respective safety management system and/or the URs are not in generally complied with, flag states may also refuse to issue compliance documents to vessels.

- The extra layers of work required in the process of cyber-proofing a vessel could prolong the construction and design processes and increase costs.

- While the burden of cyber-proofing a vessel during construction is placed more on suppliers and shipyards, prospective owners are encouraged to oversee the process, carry out checks and ensure URs are complied with.

- Vessel owners should ensure the anonymity of their guests is well preserved. Any data breaches resulting from network systems onboard being compromised could cause serious concerns and lead to claims being brought forward.

Maira Loukaki Associate, London

- The Convention for the Safety of Life at Sea: SOLAS (imo.org)

- A 1106 29 (imo.org)

- Crypto were hacked in January 2022 resulting in the unauthorised withdrawal of bitcoin and Ether worth around $35 million. Axie Infinity, an online video game, were allegedly attacked by North Korean hackers from the Lazarus Group who stole an undisclosed sum. The U.S. government recovered about $30 million of the stolen funds. Medibank were attacked in October 2022 and the attackers demanded a ransom payment of $9.7 million not to publish stolen data. Medibank refused to pay and the hackers then threatened to release data each day the ransom remained unpaid. The attack was estimated to cost Medibank $25 to $35 million.

- https://iacs.org.uk/news/iacs-adopts-new-requirements-on-cyber-safety/

- https://www.dnv.com/cybersecurity/cyber-insights/maritime-cyber-priority-2023.html

- https://insurancemarinenews.com/insurance-marine-news/iacs-adopts-new-requirements-on-cyber-safety/

- https://iacs.org.uk/news/iacs-ur-e26-and-e27-press-release

- E27 is ‘non-mandatory’ for e) passenger yachts (passengers not more than 12) and f) pleasure yachts not engaged in trade - https://iacs.s3.af-south-1.amazonaws.com/wp-content/uploads/2022/05/29103853/UR-E27-Rev.1-Sep-2023-CLN.pdf

- https://www.dnv.com/expert-story/maritime-impact/Yards-and-vendors-must-act-promptly-to-comply-with-upcoming-IACS-cyber-security-requirements.html

- https://www.american-club.com/files/files/ur-e26-new-apr-2022.pdf

- https://www.classnk.com/hp/pdf/info_service/iacs_ur_and_ui/ur_e27_rev.1_sep_2023_cln.pdf which defines a CBS as “A programmable electronic device, or interoperable set of programmable electronic devices, organized to achieve one or more specified purposes such as collection, processing, maintenance, use, sharing, dissemination, or disposition of information. CBS on-board include IT and OT systems. A CBS may be a combination of subsystems connected via network. On-board CBS may be connected directly or via public means of communications (e.g. Internet) to ashore CBSs, other vessels’ CBS and/or other facilities”.

- https://www.american-club.com/files/files/ur-e27-new-apr-2022.pdf

Comprehensively Yachts

The HFW yacht team has been an integral part of the yacht industry for over 30 years and has a physical presence in many of the major yachting jurisdictions. The enduring relationships developed with the owners, builders, designers, financiers, insurers, brokers and managers of yachts, our in-depth knowledge of the yacht industry and our international reach ensure we are pre-eminent in the field. For more information on HFW’s yacht team and the services we offer, please see www.hfwyachts.com

Download file as PDF

- Share this page on Twitter on LinkedIn via Email

- Google Plus

- Email a link to a colleague

If you would like expert insight on the latest legal and commercial developments with Covid-19 please click here .

If you would like to discuss your current priorities and the issues that you are facing, please or speak to your usual HFW contact or get in touch with our COVID-19 team at [email protected]

We are working with clients across our international network to help them minimise the impact of COVID-19 on their business and to prepare for what's next. To find out more, visit our dedicated Covid-19 hub .

Global Contacts

William maclachlan partner.

Phone: +44 (0)20 7264 8007

Full profile of William MacLachlan [email protected] --> Download VCard

Daniel Martin Partner

Phone: +44 (0)20 7264 8189

Full profile of Daniel Martin [email protected] --> Download VCard

Stephen Green Associate

Phone: +44 (0)20 7264 8000

Fax: +44 (0)20 7264 8888

Full profile of Stephen Green [email protected] --> Download VCard

Alex Kemp Partner

Phone: +44 (0)20 7264 8432

Full profile of Alex Kemp [email protected] --> Download VCard

Jenny Salmon Legal Director

Phone: +44 (0)20 7264 8501

Full profile of Jenny Salmon [email protected] --> Download VCard

Tom Walters Partner

Phone: +44 (0)20 7264 8285

Full profile of Tom Walters [email protected] --> Download VCard

Mark Thompson Senior Associate

Phone: +44 (0) 20 7264 8528

Full profile of Mark Thompson [email protected] --> Download VCard

Hélène de Ferrières Senior Associate

Phone: +33 1 44 94 31 41

Full profile of Hélène de Ferrières [email protected] --> Download VCard

William MacLachlan

+44 (0)20 7264 8007

More about William Email William

Daniel Martin

+44 (0)20 7264 8189

More about Daniel Email Daniel

Stephen Green

+44 (0)20 7264 8000

More about Stephen Email Stephen

+44 (0)20 7264 8432

More about Alex Email Alex

Jenny Salmon

Legal director.

+44 (0)20 7264 8501

More about Jenny Email Jenny

Tom Walters

+44 (0)20 7264 8285

More about Tom Email Tom

Mark Thompson

Senior associate.

+44 (0) 20 7264 8528

More about Mark Email Mark

Hélène de Ferrières

+33 1 44 94 31 41

More about Hélène Email Hélène

--> London

--> Paris

Latest News

- Twitter feed loading

Click here to visit our dedicated hub

our experts

- 24/7 crisis management

our network

Latest updates, comprehensively yachts.

HFW is an international law firm with over 600 lawyers working across our global network. We advise clients on legal issues in relation to all aspects of international commerce and we are regarded as one of the world’s leading shipping law firms. The expertise, experience and reputation earned in commercial shipping over our nearly 140 years in business is carried into our yacht practice.

Our yacht team has been an integral part of the yacht industry for over 30 years and has a physical presence in many of the major yachting jurisdictions. The enduring relationships developed with the owners, builders, designers, financiers, insurers, brokers and managers of yachts, our in-depth knowledge of the yacht industry and our international reach ensure we are pre-eminent in the field.

Holman Fenwick has a market-leading yacht practice which draws on the experience of its world-renowned shipping team. Holman Fenwick is regarded as “one of the most prominent firms around,” with a “very high profile in the yachting world.” The firm represents some of the world’s leading shipyards as well as a number of prominent HNW yacht owners.

“Every question, advice or legal paper concerning my business is individually tailored to the project or client; HFW has proven to be able to handle it all. They are very well connected within the industry and are viewed as an industry standard.”

“Between the Monaco and London offices, and a global presence, their network allows them to address every issue that may arise in yachting.”

“HFW are an excellent yacht and maritime law firm,” says an interviewee, who adds that “they have a very deep bench and an extremely well-qualified yacht law team.” The firm’s “extremely professional” yacht lawyers advise clients on sophisticated cross-border financings, transactions and contentious matters.

“HFW are well positioned in the super yacht industry to have in-depth market and commercial knowledge,” says a source.

Our yacht team is positioned to assist with any aspect of constructing, purchasing and operating a yacht. We, of course, cannot disclose details of our clients or any of the projects in which we have been involved. However, we are routinely involved in some of the largest and most complex projects in the yacht industry.

Design agreements and intellectual property issues

Construction agreements

- Pre and post-delivery financing, restructuring and work out arrangements

Yacht sale and purchase transactions

Ownership structures

Registration arrangements

Import and export formalities

VAT/Customs issues

Management agreements

Crewing and employment matters

Refit and repair contracts

- Charter agreements

Sale and purchase of berths

Physical and cyber security arrangements

Health, safety and regulatory compliance

Business jets and helicopters

- Tenders, submersibles and other ancillary equipment

Yacht arrest and dispute resolution

Admiralty and crisis management

- Insurance arrangements, including questions of coverage

Jay specialises in yacht and ship building, yacht and ship sale and purchase, yacht, ship and asset finance, corporate law and international trade.

Position : Partner Specialism : Transactional

London Tel: +44 (0)20 7264 8386 Email Jay

Andrew Charlier

Andrew Charlier is co-head of HFW’s yacht team and head of the firm’s Monaco office. He specialises in yacht purchase and sale, construction and finance, with 30 years’ experience of representing owners on all aspects of the yachting industry. He also assists clients with the sale, purchase and ownership of private jets.

Monaco Tel: +377 92 00 13 22 Email Andrew

William MacLachlan

William advises on a wide range of yacht related matters with a particular focus on VAT, design/intellectual property, construction, sale and purchase, charter, management, refit and repair, and also advises on physical and cyber security on board yachts. He spent 8 months seconded to a leading German yacht builder.

William is a trustee of the Mission to Seafarers, one of HFW’s global charity partners, and a member of the board of advisers of the ‘She of the Sea’ campaign to encourage diversity amongst those employed at sea in the yachting industry.

London Tel: +44 (0)20 7264 8007 Email William

Adam has over 20 years’ experience in the industry and acts regularly for banks and other financial institutions as well as for owners, advising them on finance transactions and sale and purchase of yachts, as well as registrations, management and operating issues.

London Tel: +44 (0)20 7264 8264 Email Adam

Alistair Feeney

Alistair has more than 15 years’ experience of handling disputes relating to yacht construction, sale and purchase, refit and repair, charters and broking. He has acted for builders, owners, charterers and brokers in arbitration and court proceedings in many jurisdictions, including obtaining arrest orders and other protective measures. Alistair works closely with other members of HFW’s yacht team in managing disputes from an early stage, with the aim of achieving early, successful outcomes.

Position : Partner Specialism : Disputes

London Tel: +44 (0)20 7264 8424 Email Alistair

Tom Walters

Before joining HFW in 2002, Tom worked for seven years for a naval architecture practice on the UK’s south coast designing superyachts. Tom regularly deals with yacht casualties, insurance claims and transportation disputes. His technical background means he has also been involved with a number of technical cases and construction disputes concerning yachts. Tom advises on the use of Maritime Autonomous Systems (MAS) technology in response to the increasing demand for autonomous underwater vehicles (AUVs) and Autonomous Surface Vessels (ASVs). Tom is a member of The Royal Institution of Naval Architects (RINA) and works with the Society of Underwater Technology (SUT) advising on various legal issues. He is also a member of various SUT Sub-Committees, including Salvage & Emergency Subsea Response and Technology and Innovation.

Position : Partner Specialism : Insurance & Admiralty & Crisis Management

London Tel: +44 (0)20 7264 8285 Email Tom

Alex specialises in marine insurance and crisis response. He has advised both yacht owners and insurers on a variety of matters affecting large yachts, including fires, groundings, missing vessels, damage sustained whilst being transported, structural defects, main engine damage and damage to gel coatings. He has also advised on yacht casualties including those requiring salvage assistance. Alex has undertaken a secondment at a leading London marine insurer.

London Tel: +44 (0)20 7264 8432 Email Alex

Alex Sayegh

Alex specialises in the transactional aspects of the commercial yachting industries; advising owners, shipyards and financiers on the construction, refit, repair, sale and purchase of various types of vessels. He has a particular focus on construction contracts for new builds and has extensive experience of negotiating with shipyards and yacht builders throughout the world. Alex also regularly lectures on the subjects of shipbuilding and sale and purchase contracts.

Position : Legal Director Specialism : Transactional

London Tel: +44 (0)20 7264 8394 Email Alex

Jessica Taylor

Jessica specialises in the transactional side of yachting and commercial shipping, advising owners, shipyards, financial institutions, brokerage houses, and designers on all aspects of the construction, refit, sale and purchase, design, management, crewing and chartering of large yachts.

London Tel: +44 (0)20 7264 8020 Email Jessica

Thomas Willan

Thomas specialises in asset finance, with a particular emphasis on ship, superyacht and aviation finance. He advises commercial and private wealth banks and other financial institutions, investors, owners, charterers and manufacturers in connection with pre- and post-delivery bilateral and syndicated financings and general banking arrangements. His work also covers sale and purchase, leasing arrangements, restructurings and workouts. Thomas has spent time on client secondment at a specialist transport finance bank.

London Tel: +44 (0)20 7264 8544 Email Thomas

Ian is a banking and finance lawyer with specialist experience in the shipping, superyacht, offshore and aviation sectors. Ian advises banks and other financial institutions, funds, Islamic investors, insurance companies and owners on a variety of matters including new financings, sale and purchase, leasing, restructurings, work outs and enforcements.

Ian is a member of the executive committee of Superyacht UK (part of the British Marine Federation), the membership association of the UK superyacht industry, representing the interests of the industry in the UK and internationally.

London Tel: +44 (0)20 7264 8274 Email Ian

Michelle Chance

Michelle Chance has over 20 years’ experience advising on complex and sensitive employment matters, which often involve discrimination and where the stakes in terms of monetary value and reputational risk are high. Michelle’s specific yacht experience includes advising on the impact of sanctions on potential employment claims of unionised crew members, as well as drafting seafarers employment agreements and advising on and updating employment policies and procedures for crew members in the light of an International Human Rights At Sea investigation into claims of bullying and harassment.

Position : Partner Specialism : Employment

London Tel: +44 (0)20 7264 8384 Email Michelle

Mark Thompson

Mark is a Senior Master Mariner and forms part of our shipping emergency response team. Mark deals with yacht casualties, including fires, collisions, groundings, helicopter incidents, tender/PWC related accidents, pollution, total loss and salvage. Mark attends the scene of yacht casualties in order to manage the casualty response, liaise with other interested parties and protect or Clients’ interests.

Before joining HFW, Mark had 17 years seagoing experience, and has sailed as Master on high speed passenger vessels and freight RoRo vessels. Mark has a background as a marine casualty investigator, holds a Post Graduate Diploma in Applied Navigation, HND in Nautical Science and is qualified as a Specialist Navigating Officer with the Royal Navy.

Position : Senior Master Mariner Specialism : Admiralty & Crisis Management

London Tel: +44 (0) 20 7264 8528 Email Mark

Zoe Triantafyllou

Zoe advises yacht finance providers and yacht owners on a wide range of transactional matters including debt finance, export credit finance, leasing structures, restructuring, refinancing and sale and purchase.

She has also spent time working at HFW’s Piraeus office and speaks fluent Greek.

Position : Senior Associate Specialism : Transactional

London Tel: +44 (0)20 7264 8243 Email Zoe

Amalia Tzima

Amalia specialises in the transactional aspects of yachting. She advises owners, shipyards, brokerage houses and designers on matters involving the construction, refit/repair, design, sale and purchase, management and registration of yachts.

Position : Associate Specialism : Transactional

London Tel: +44 (0)20 7264 8220 Email Amalia

Zain specialises in transactional, finance and corporate work and advises yacht owners on yacht sale and purchase, crewing and management arrangements.

London Tel: +44 (0)20 7264 8369

Pauline Arroyo

Pauline Arroyo is a partner based in HFW’s Paris office. With a broad experience in yacht-related VAT and customs matters, she advises on EU and French VAT and customs issues in all types of yacht transactions and assists owners and yacht managers in relation to the context of customs controls and litigation in France.

Position : Partner Specialism : Insurance & VAT

Paris Tel: +33 1 44 94 40 50 Email Pauline

Stéphanie Schweitzer

Stéphanie has extensive experience in yacht-related employment and personal injury matters. She regularly advises yacht owners and insurers in relation to passenger claims, crew contracts and claims and social security issues. Stéphanie also often assists clients of the yachting industry in relation to contract of carriage, charter parties and yacht arrests.

Position : Partner Specialism : Disputes & Personal Injury

Paris Tel: +33 1 44 94 31 64 Email Stephanie

Rosina Dyke

Rosina specialises in the transactional aspects of yachting. She primarily advises owners and financial institutions on the sale, purchase, construction, refit, financing, and registration of yachts and the corporate entity that holds them.

Paris Tel: +33 (0)1 44 94 31 62 Email Rosina

Ian Cranston

Ian is particularly lauded for his shipping and yacht expertise. He has close to 30 years’ experience in successfully handling yachting disputes in arbitration and court proceedings and generally advising owners, charterers, brokers and yards on matters related to yacht sale & purchase, charter, refit and construction.

Monaco Tel: +377 92 00 13 21 Email Ian

Richard Mabane

Richard has been a litigation partner at HFW since 2001, with particular expertise in relation to shipbuilding and repair, charterparties and ship sale disputes. In early 2023 he relocated to our Monaco office with a view to doing more yacht-related work. A highly successful trial lawyer (he has won all 23 of the cases he has taken to trial), Richard is also a strong advocate of mediation, where also has a high success rate, having settled over 90% of his 35 mediations on the day.

Fluent in Italian and French, Richard has very close connections with Italy and a number of longstanding Italian clients. In the field of yachting, he has handled yacht construction, refit and repair, sale and purchase and charter disputes.

Monaco Tel: D +377 92 00 13 23 Email Richard

George Kaye

George specialises in dispute resolution and regularly advises owners, charterers and brokers on matters involving yacht construction, sale and purchase and charter.

Position : Senior Associate Specialism : Disputes

Monaco Tel: +377 92 00 13 26 Email George

Middle East, Asia Pacific and the Americas

Tien has extensive experience in our non-contentious practice, with special focus on yacht building, sale and purchase, registration, crewing and finance in all the major yacht registries including the UAE. His recent experience includes negotiation of yacht refit contracts with GCC yards. Tien has spent time on client secondment at the ship finance team of an international bank.

Dubai Tel: +971 4423 0555 Email Tien

Patrick Cheung

Patrick has extensive transactional experience, with a special focus on ship and yacht building, sale and purchase, registration and finance as well as private jet finance, registration, management and operation agreements.

Hong Kong Tel: +852 3983 7778 Email Patrick

Angie is a corporate and finance lawyer with a broad non-contentious practice. Her yacht expertise includes yacht sale and purchase, construction and yacht registration, as well as yacht finance and other commercial yacht-related matters. Fully tri-lingual in English, Cantonese and Mandarin, Angie often advises clients within Hong Kong and mainland China.

Hong Kong/Shanghai Tel: +852 3983 7779 Tel: +86 21 2080 1133 Email Angie

Henry has an established transactional and contentious practice. His transactional experience includes yacht and construction, sale and purchase and finance matters. On the contentious side, Henry acts for yacht owners, buyers and sellers and shipyards on matters including shipbuilding and MoA disputes, charterparty disputes, personal injury claims and insurance claims. He also acts in crew claims and enforcement.

Position : Partner Specialism : Disputes & Transactional

Hong Kong/Shanghai Tel: +852 3983 7777 Tel: +86 21 2080 1111 Email Henry

John Forrester

John heads the firm’s Asia Pacific Ship Finance practice. He specialises in asset finance and other transactional work across the maritime sector. He represents clients on a wide range of transactional matters, including financing, construction contracts, vessel sale and purchase, vessel registration, charters, joint ventures and debt restructuring/work-outs.

Singapore Tel: +65 6411 5350 Email John

Stephen Thomson

Stephen has over 20 years in the industry, advising on yacht sale and purchase, the importation and exportation process under Australian law, as well as management and refit/repair contracts. He also represents clients in relation to ligation arising out of yacht construction disputes and personal injury claims.

Sydney Tel:: +61 (0)2 9320 4646 Email Stephen

Ranjani Sundar

Ranjani has broad experience in yacht-related matters, including yacht sale and purchase, Australian Customs considerations for the import and/or export of yachts and personal injury matters. Ranjani acts for yacht owners and insurers in both contentious and non-contentious matters.

Sydney Tel: +61 (0)2 9320 4609 Email Ranjani

Gavin Vallely

Gavin has more than 25 years’ experience advising on contentious and non-contentious matters concerning commercial shipping and international trade. His work in relation to yachts has included advising on Australian flag and survey requirements, sale and purchase, construction and repair, importation and related duty and taxation considerations. He is consistently recognised as one of Australia’s leading maritime lawyers and is ranked as a Band 1 practitioner in Chambers Asia-Pacific Guide and Legal 500. He is described in the Legal 500 as having “ unsurpassed maritime sector knowledge “. Gavin is admitted to practice as a solicitor in Australia and England & Wales.

Position : Partner Specialism : Transactional & Disputes

Melbourne Tel: +61 (0)3 8601 4523 Email Gavin

Owen specialises in yacht-related disputes. He regularly handles matters concerning the sale and purchase, charter, mortgaging and arrest of superyachts for owners, charterers, brokers and financial institutions.

Position : Special Counsel Specialism : Disputes

Melbourne Tel: +61 (0)3 8601 4526 Email Owen

24/7 Crisis Management

Universally regarded as one of the world’s leading crisis management law firms, we advise on all legal issues arising from yacht related emergencies, including collisions, grounding, damage in transit, pollution, fire and explosion, salvage, wreck removal and towage, as well as security, political violence, piracy, kidnap and ransom and cyber breaches. Our yacht team includes several leading crisis management and marine insurance experts and is supported by our global admiralty and crisis management team. Members of our admiralty and crisis management team are available year round 24/7 to attend emergencies. With our global network, a bespoke team can be assembled and, if needed, on location within 24 hours practically anywhere in the world.

Our expertise in managing crisis of all types, combined with our understanding of the specialised and sophisticated operations involved in yachting and the yachting industry’s specific concerns regarding confidentiality and privacy, enable us to protect our clients’ interests in the most appropriate and timely manner.

We operate a dedicated crisis management suite in our London office, which can be immediately utilised by our clients and become an extension of their own in-house team. Our admiralty and crisis management team are media trained and on hand to offer:

Immediate incident response support

Advice on regulatory and compliance issues arising out of an incident

Reputation management / media response

Advice on post incident claims handling

In addition, we recognise the importance of preparation in mitigating liability and we regularly advise clients on their crisis management procedures and emergency response policies, including ensuring that their appetite for risk and potential contractual liabilities dovetail with their insurance coverage and internal crisis management procedures.

Our marine insurance and crisis management team

In addition to the support available from our firm’s world renowned admiralty and crisis management team, our yacht team includes experienced casualty response lawyers, a former naval architect experienced in the design of large yachts and master mariners with experience of navigating and operating large yachts, warships and passenger vessels. Our key contacts for yacht related crisis response and marine insurance issues are:

London Tel: +44 (0)20 7264 8528 Email Mark

24 hour emergency telephone number +44 (0)20 7709 7702

We have a strong international brand and a rapidly growing network of offices. With over 600 lawyers working in offices across Asia, Australia, the Middle East, Europe and the Americas, we have a presence in many of the major centres of yacht ownership and operation in the world. Frequently we resource our matters with team members drawn from different offices and time zones to provide our clients, wherever they are, with the resources of a truly global yacht team.

Our yacht team includes lawyers fluent in English, French, German, Italian, Russian and Chinese and is able to draw on the support of colleagues across our wider firm who between them speak over 40 different languages.

January 24 |

Industry update

With 2023 drawing to a close, we are delighted to present the latest edition of Comprehensively Yachts . In this edition, we discuss the impact of Russian sanctions on the yachting industry. Next, our marine insurance specialists consider whether the widely used American Yacht Form R12 is still fit for purpose or whether the time is right for the marine insurance industry to move on to a bespoke wording. Our admiralty team explore the law behind a yacht’s AIS transmission and how you might achieve ex- directory status, as the temptation to turn this feature off to ensure the privacy of your charter is ever growing given the risked poses by the development of smart phone technology. Our Paris office reports on a recent land-mark conviction of the captain of a 26 meter yacht by the Maritime Court of Marseille following his repeated anchoring in protected posidonia meadows and the threat such conviction has for the wider yachting industry. Finally, we round out this edition with a long read on Cyber Security , the increasing regulation around it and the growing need to take it seriously.

August 23 |

HFW’s yacht team has once again been ranked Band 1 in the Chambers and Partners High Net Worth Yachts & Superyachts guide . Five members of our industry leading team have also been recognised. Chambers noted that “between the Monaco and London offices, and a global presence, their network allows them to address every issue that may arise in yachting.”

As we enter another Mediterranean yacht season we are pleased to bring you a bumper edition of Comprehensively Yachts . In this edition, we begin with a look at yachting’s role in the development of future sustainable technology in the move towards more sustainable yachting . Secondly, our sanctions experts consider briefly the latest developments in a recent, high profile case. Our employment colleagues consider the steps that can be taken to ensure a positive working environment in the yachting industry. Next, our British Virgin Islands team review the impact of the recent blacklisting of the British Virgin Islands by the EU Council. Finally, we finish with a detailed analysis from our admiralty and crisis management colleagues of recent yacht casualty trends and suggestions for how the risk of a serious incident be mitigated.

Who we are What we do Our experts Our network HFW main website HFW Shipping

Legal Notices Privacy Notice Accessibility Anti-Modern Slavery Statement Disaster Recovery

By Pantaenius 21 Sep 2015

The Galatea Basis of Agreed Value: Market Value or New Replacement Value?

The claimant insured in the recently decided case of “the galatea” purchased a new 35m motor yacht m/y galatea for €13 million in 2007. the yacht was insured under the “all risks” american yacht form r12 policy wording by the….

The claimant insured in the recently decided case of “The Galatea” purchased a new 35m motor yacht M/Y Galatea for €13 million in 2007. The yacht was insured under the “all risks” American Yacht Form R12 policy wording by the defendant underwriters for an agreed value €13 million in 2011.

The yacht caught fire at her mooring in Athens in late 2011. She suffered extensive damage and as a result thereof was a constructive total loss. Following the loss, the underwriters reserved their rights - the underwriters’ principle complaint being that the yacht was over-valued.

The English Courts recently held that, on the facts of the case of “The Galatea”, the underwriters were entitled to avoid the contract of insurance from inception because the insured, who has represented the market value of the yacht to be €13 million, had failed to disclose prior to the inception of cover that:

a) a professional valuation of the yacht valuing her at €7 million had been obtained in 2009; and

b) it had decided to market the yacht for sale with an asking price of €8 million (together the “non-disclosure”).

The non-disclosure was found by the Court to be material because the custom and practice of the London yacht insurance market was to insure yachts on an agreed value based on a yacht’s market value at the commencement of the insurance.

The result would have been very different had M/Y Galatea been insured under the Pantaenius Superyacht Clauses (“PSYC”) because:

PSYC makes it very clear (at Section A 3.1) that:

• A yacht insured through Pantaenius is insured for an Agreed Fixed Value (which is based on the new replacement value of the yacht at the commencement of the insurance); and

• The insured will not be penalised for under-insuring or over-insuring the value of the Yacht.

Accordingly in the light of the above express provisions of PSYC, the non-disclosure in The Galatea would not have been material and the insurance contract would not have been avoided because an insured under PSYC is not penalised for under-insuring or over-insuring the value of the Yacht.

www.pantaenius.com

Press Contact:

Name: Anna Baum E-mail: [email protected] Phone: +49 40 37091 0 Fax: +49 40 37091 109

View company profile

The entity that submits this press release to SuperyachtNews.com hereby accepts sole responsibility for the facts, accuracy and completeness of the content. All content and mediums submitted are an acknowledgement of the suitability for publication. SuperyachtNews.com accepts no liability or responsibility for any inaccuracies or errors made by the submitter in this regard.

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here .

Sign up to the SuperyachtNews Bulletin

Receive unrivalled market intelligence, weekly headlines and the most relevant and insightful journalism directly to your inbox.

Sign up to the SuperyachtNews Bulletin

The superyachtnews app.

Follow us on

Media Pack Request

Please select exactly what you would like to receive from us by ticking the boxes below:

SuperyachtNews.com

HFW Comprehensively Yachts Industry Briefing 2023

It has been another busy year for HFW, and the yacht team are delighted to present the latest edition of Comprehensively Yachts. Packed with topical comment and analysis this edition looks at the economic impact of Russian sanctions. Twenty-one months since the invasion of Ukraine, the yachting industry, having been hard hit by the sanctions has largely settled down and found new business to replace that which has been lost or turned away.

However, the risk of an inadvertent sanctions breach remains for those not taking care when onboarding new clients and accordingly HFW starts with a look at the current sanctions landscape from the market leading sanctions team, together with a round-up of some of the high profile ongoing legal challenges.

Next, HFW marine insurance specialists consider whether the widely used American Yacht Form R12 is still fit for purpose or whether the time is right for the marine insurance industry to move on to a bespoke wording better suited to English law and the practices of both the London insurance market and the modern yachting industry.

Finally, the possibility of anonymously enjoying beautiful places in the company of your friends and family from the privacy of your yacht is key to the allure of yachting. However, with AIS technology enabling everyone with a smart phone to know your yacht’s every move, the temptation to turn off a yacht’s AIS transmission and “go dark” is real. HFW admiralty team explores the law behind the transmission and how, if at all, you might achieve an ex-directory status.

Our Paris office reports on a recent land-mark conviction of the captain of a 26-metre yacht by the Maritime Court of Marseille following his repeated anchoring in protected Posidonia meadows and the threat such conviction has for the wider yachting industry.

Finally, this edition of Comprehensively Yachts provides a long read on Cyber Security, the increasing regulations around it and the growing need to take it seriously. HFW hopes you enjoy this edition and if there is anything you would like to discuss in forthcoming editions, please do let the team know.

www.hfw.com/Comprehensively-Yachts-Industry-Briefing-Dec-23

- Hull & Machinery

- Protection & Indemnity

- Yacht Insurance

- Marina Insurance

- Freight Demurrage and Defense (FD&D)

- Ship Repairers Liability

- Builder’s Risk

- Jones Act, United States Longshoreman and Harbor Worker’s Compensation Act, Marine Employer’s Liability Cover

Yacht Insurance is an insurance product written to cover the owners of private pleasure vessels; from small runabouts to multimillion dollar sail or power yachts. The product is typically written as a package to include both Hull & Machinery and Liability ( Protection & Indemnity ). Examples of well known yacht standard wordings are the Institute Yacht Clauses, Clause 328 or the American Yacht Form R12. However, often now insurers have created their own bespoke wordings to include what is needed by today’s yacht owners. Wordings can be extended to include cover for machinery, extended cover for valuable fishing tackle, damage to the lower unit due to striking a submerged object, fine arts coverage, war/confiscation, even loss of wine due to wine storage facility breakdown. Coverage can be extended to cover toys, tenders, dinghies, personal watercraft and diving gear.

- SuperyachtNews

- SuperyachtIntelligence

The claimant insured in the recently decided case of “The Galatea” purchased a new 35m motor yacht M/Y Galatea for €13 million in 2007. The yacht was insured under the “all risks” American Yacht Form R12 policy wording by the defendant underwriters for an agreed value €13 million in 2011.

The yacht caught fire at her mooring in Athens in late 2011. She suffered extensive damage and as a result thereof was a constructive total loss. Following the loss, the underwriters reserved their rights - the underwriters’ principle complaint being that the yacht was over-valued.

The English Courts recently held that, on the facts of the case of “The Galatea”, the underwriters were entitled to avoid the contract of insurance from inception because the insured, who has represented the market value of the yacht to be €13 million, had failed to disclose prior to the inception of cover that:

a) a professional valuation of the yacht valuing her at €7 million had been obtained in 2009; and

b) it had decided to market the yacht for sale with an asking price of €8 million (together the “non-disclosure”).