A Wealth of Common Sense

10 Great Lines From ‘Where Are the Customers’ Yachts?’

Posted February 15, 2015 by Ben Carlson

Where Are the Customers’ Yachts by Fred Schwed was written almost 75 years ago. I only read this book for the first time a few months ago and it’s remarkable how well it still holds up after all these years. It’s probably the funniest investment book I’ve ever read (out of an admittedly small set of competitors).

Here are some of my favorite lines:

1. On using statistics to your advantage: “One can’t say that figures lie. But figures as used in financial arguments, seem to have the bad habit of expressing a small part of the truth forcibly, and neglecting the other part, as do some people we know.”

2. On the value of “I don’t know”: For one thing, customers have an unfortunate habit of asking about the financial future. Now, if you do someone the single honor of asking him a difficult question, you may be assured that you will get a detailed answer. Rarely will it be the most difficult of all answers – “I don’t know.”

3. On the cyclical nature of the markets: “When “conditions” are good, the forward looking investor buys. But when “conditions” are good, stocks are high. Then without anyone having the courtesy to ring a bell, “conditions” get bad.”

4. On the usefulness of theories: “All of these theories are true part of the time; none of them true all of the time. They are, therefore, dangerous, though sometimes useful.”

5. It’s a little different every time: “History does in a vague way repeat itself, but it does it slowly and ponderously, and with an infinite number of surprising variations.

6. On the emotions of losing money: “Like all of life’s rich emotional experiences, the full flavor of losing important money cannot be conveyed by literature. You cannot convey to an inexperienced girl what it is truly like to be a wife and mother. There are certain things that cannot be adequately explained to a virgin by words or pictures.”

7. On second-level thinking: “Those classes of investments considered “best” change from period to period. The pathetic fallacy is that what are thought to be the best are in truth only the most popular – the most active, the most talked of, the most boosted, and consequently, the highest in price at that time.”

8. On leverage: “A man who borrows money to buy a common stock has no right to think of himself as a constructive social benefactor. His is just another fellow trying to be smart, or lucky, or both.”

9. On short sellers before the Great Depression: “Before October 1929, nobody objected to short sellers except their families. The families objected to going bankrupt.”

10. On who’s to blame for poor advice: “The burnt customer certainly prefers to believe that he has been robbed rather than that he has been a fool on the advice of fools.”

Source: Where Are the Customers’ Yachts

Now go talk about it.

What's been said:.

[…] and commentary on today’s financial services industry as well as the economy and markets. This post presents the blog author’s 10 favorite lines from the […]

[…] Ben Carlson plucks a few gems from Fred Schwed (A Wealth Of Common Sense) […]

[…] paraphrase Fred Schwed, there are certain things that can’t be taught, but only learned through experience. Is […]

[…] the best response to the sentence “A rising tide lifts all boats,” is “Where Are The Customers’ Yachts?” For those who have not yet read this 75 year old classic – it’s still available, and […]

[…] Further Reading: Experience of Expertise? 10 Great Lines From ‘Where Are The Customers’ Yachts?’ […]

[…] 10 Great Lines From ‘Where Are the Customers’ Yachts?’ – Link here […]

More from my site

- Should Your Investment Manager Have Skin in the Game?

- The Bond Market is Getting Interesting

- Animal Spirits: Oil’s 1987 Moment

- @awealthofcs

BEN CARLSON, CFA

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. I manage portfolios for institutions and individuals at Ritholtz Wealth Management LLC . More about me here . For disclosure information please see here .

Get Some Common Sense

Email address:

Get a Full Investor Curriculum: Join The Book List

Every month you'll receive 3-4 book suggestions--chosen by hand from more than 1,000 books. You'll also receive an extensive curriculum (books, articles, papers, videos) in PDF form right away.

Where Are the Customers' Yachts?: or A Good Hard Look at Wall Street

Fred schwed jr. , peter arno ( illustrator ) , jason zweig ( introduction ).

208 pages, Paperback

First published January 1, 1940

About the author

Fred Schwed Jr.

Ratings & reviews.

What do you think? Rate this book Write a Review

Friends & Following

Community reviews.

Join the discussion

Can't find what you're looking for.

Where Are the Customers' Yachts?

- or A Good Hard Look at Wall Street

- By: Fred Schwed Jr. , Peter Arno

- Narrated by: Mark Moseley

- Length: 4 hrs and 2 mins

- 4.4 out of 5 stars 4.4 (131 ratings)

Add to Cart failed.

Add to wish list failed., remove from wishlist failed., adding to library failed, follow podcast failed, unfollow podcast failed.

$7.95 a month after 30 days. Cancel anytime.

Buy for $13.01

No default payment method selected.

We are sorry. we are not allowed to sell this product with the selected payment method, listeners also enjoyed....

Warren Buffett's Ground Rules

- Words of Wisdom from the Partnership Letters of the World's Greatest Investor

By: Jeremy C. Miller

- Narrated by: Tom Perkins

- Length: 10 hrs and 11 mins

- Overall 4.5 out of 5 stars 348

- Performance 4.5 out of 5 stars 285

- Story 4.5 out of 5 stars 286

Compiled for the first time, and with Buffett's permission, these letters spotlight his contrarian diversification strategy, his almost religious celebration of compounding interest, his preference for conservative rather than conventional decision making, and his goal and tactics for bettering market results by at least 10 percent annually. Demonstrating Buffett's intellectual rigor, they provide a framework to the craft of investing that had not existed before.

- 5 out of 5 stars

Absolutely fantastic

- By Matthew on 08-18-16

Common Stocks and Uncommon Profits

By: Philip A. Fisher

- Narrated by: George Guidall

- Length: 2 hrs and 55 mins

- Overall 4.5 out of 5 stars 1,237

- Performance 4.5 out of 5 stars 942

- Story 4.5 out of 5 stars 934

One of the most important works ever written on investment theory, Common Stocks and Uncommon Profits lays out the fundamental principles of intelligent investing.

- 1 out of 5 stars

Uncommonly Technical

- By Jan on 03-18-03

The Clash of the Cultures

- Investment vs. Speculation

- By: John C. Bogle, Arthur Levitt - foreword

- Narrated by: Al Kessel

- Length: 13 hrs and 11 mins

- Overall 4.5 out of 5 stars 56

- Performance 4.5 out of 5 stars 51

- Story 4 out of 5 stars 48

Provocative and refreshingly candid, this audiobook discusses Mr. Bogle's views on the changing culture in the mutual fund industry, how speculation has invaded our national retirement system, the failure of our institutional money managers to effectively participate in corporate governance, and the need for a federal standard of fiduciary duty.

- 3 out of 5 stars

Dry as all Hell

- By Pablo Lema on 09-13-19

By: John C. Bogle , and others

The Outsiders

- Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

By: William N. Thorndike

- Narrated by: Brian Troxell

- Length: 5 hrs and 52 mins

- Overall 4.5 out of 5 stars 2,629

- Performance 4.5 out of 5 stars 2,167

- Story 4.5 out of 5 stars 2,155

In The Outsiders , you'll learn the traits and methods striking for their consistency and relentless rationality that helped these unique leaders achieve such exceptional performance. Humble, unassuming, and often frugal, these "outsiders" shunned Wall Street and the press, and shied away from the hottest new management trends. Instead, they shared specific traits that put them and the companies they led on winning trajectories: a laser-sharp focus on per share value as opposed to earnings or sales growth; an exceptional talent for allocating capital and human resources; and the belief that cash flow, not reported earnings, determines a company's long-term value.

- 4 out of 5 stars

Great summary of the 8 CEOs, lessons to learn from

- By Jason S on 09-04-19

By: Walter Isaacson

- Narrated by: Jeremy Bobb, Walter Isaacson

- Length: 20 hrs and 39 mins

- Overall 5 out of 5 stars 5,909

- Performance 5 out of 5 stars 5,315

- Story 5 out of 5 stars 5,309

When Elon Musk was a kid in South Africa, he was regularly beaten by bullies. One day a group pushed him down some concrete steps and kicked him until his face was a swollen ball of flesh. He was in the hospital for a week. But the physical scars were minor compared to the emotional ones inflicted by his father, an engineer, rogue, and charismatic fantasist.

megalomania on display

- By JP on 09-12-23

The Most Important Thing

- Uncommon Sense for The Thoughtful Investor

By: Howard Marks

- Narrated by: John FitzGibbon

- Length: 7 hrs and 9 mins

- Overall 4.5 out of 5 stars 2,258

- Performance 4.5 out of 5 stars 1,833

- Story 4.5 out of 5 stars 1,812

Howard Marks, the chairman and cofounder of Oaktree Capital Management, is renowned for his insightful assessments of market opportunity and risk. After four decades spent ascending to the top of the investment management profession, he is today sought out by the world's leading value investors, and his client memos brim with insightful commentary and a time-tested, fundamental philosophy. The Most Important Thing explains the keys to successful investment and the pitfalls that can destroy capital or ruin a career.

Five Star Book, two Star Audiobook

- By Johnny on 06-08-15

The Intelligent Investor Rev Ed.

By: Benjamin Graham

- Narrated by: Luke Daniels

- Length: 17 hrs and 48 mins

- Overall 4.5 out of 5 stars 7,014

- Performance 4.5 out of 5 stars 5,793

- Story 4.5 out of 5 stars 5,739

The greatest investment advisor of the 20th century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of "value investing" - which shields investors from substantial error and teaches them to develop long-term strategies - has made The Intelligent Investor the stock market Bible ever since its original publication in 1949.

- 2 out of 5 stars

This book does not belong on audio

- By Craig on 09-12-17

The Little Book of Common Sense Investing

- The Only Way to Guarantee Your Fair Share of Stock Market Returns, 10th Anniversary Edition

By: John C. Bogle

- Narrated by: L. J. Ganser

- Length: 5 hrs and 50 mins

- Overall 4.5 out of 5 stars 2,453

- Performance 4.5 out of 5 stars 2,019

- Story 4.5 out of 5 stars 1,996

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

One star for every point this 5 hour book makes.

- By Matt on 01-31-19

Security Analysis: Sixth Edition

- Foreword by Warren Buffett

- By: Benjamin Graham, David Dodd

- Narrated by: Scott R. Pollak

- Length: 32 hrs and 23 mins

- Overall 4.5 out of 5 stars 199

- Performance 4.5 out of 5 stars 156

- Story 4.5 out of 5 stars 154

First published in 1934, Security Analysis is one of the most influential financial books ever written. Selling more than one million copies through five editions, it has provided generations of investors with the timeless value investing philosophy and techniques of Benjamin Graham and David L. Dodd. As relevant today as when they first appeared nearly 75 years ago, the teachings of Benjamin Graham, “the father of value investing”, have withstood the test of time across a wide diversity of market conditions, countries, and asset classes.

Amazing Book

- By Mike on 01-17-20

By: Benjamin Graham , and others

By: Phil Knight

- Narrated by: Norbert Leo Butz, Phil Knight - introduction

- Length: 13 hrs and 21 mins

- Overall 5 out of 5 stars 51,811

- Performance 5 out of 5 stars 45,852

- Story 5 out of 5 stars 45,780

In this candid and riveting memoir, for the first time ever, Nike founder and CEO Phil Knight shares the inside story of the company's early days as an intrepid start-up and its evolution into one of the world's most iconic, game-changing, and profitable brands.

Just read it. (or listen, whatever)

- By Dan D on 07-07-16

Charlie Munger

- The Complete Investor

By: Tren Griffin

- Narrated by: Fred Stella

- Length: 6 hrs and 21 mins

- Overall 4.5 out of 5 stars 1,678

- Performance 4.5 out of 5 stars 1,375

- Story 4.5 out of 5 stars 1,375

Charlie Munger, Berkshire Hathaway's visionary vice chairman and Warren Buffett's indispensable financial partner, has outperformed market indexes again and again, and he believes any investor can do the same. His notion of "elementary, worldly wisdom" - a set of interdisciplinary mental models involving economics, business, psychology, ethics, and management - allows him to keep his emotions out of his investments and avoid the common pitfalls of bad judgment.

Good, but... one major annoyance

- By Joseph R. Compton on 02-26-16

Common Stocks and Uncommon Profits and Other Writings

- 2nd Edition

- By: Philip A. Fisher, Kenneth L. Fisher - introduction contributor

- Narrated by: Christopher Grove

- Length: 13 hrs and 10 mins

- Overall 4.5 out of 5 stars 158

- Performance 4.5 out of 5 stars 123

- Story 4.5 out of 5 stars 123

Widely respected and admired, Philip Fisher is among the most influential investors of all time. His investment philosophies, introduced almost 40 years ago, are not only studied and applied by today's financiers and investors, but are also regarded by many as gospel. This book is invaluable for investors and has been since it was first published in 1958. This updated edition retains the investment wisdom of the original edition and includes the perspectives of the author's son Ken Fisher, an investment guru in his own right, in an expanded preface and introduction.

Not worth the hype

- By Pablo Lema on 07-11-20

By: Philip A. Fisher , and others

Principles for Dealing with the Changing World Order

- Why Nations Succeed or Fail

By: Ray Dalio

- Narrated by: Jeremy Bobb, Ray Dalio

- Length: 16 hrs and 48 mins

- Overall 4.5 out of 5 stars 4,698

- Performance 4.5 out of 5 stars 3,918

- Story 4.5 out of 5 stars 3,894

From legendary investor Ray Dalio, author of the number-one New York Times best seller Principles , who has spent half a century studying global economies and markets, Principles for Dealing with the Changing World Order examines history’s most turbulent economic and political periods to reveal why the times ahead will likely be radically different from those we’ve experienced in our lifetimes - and to offer practical advice on how to navigate them well.

Ray Dalio, Chinas New Minister of Propoganda

- By Dudley on 01-04-22

Fooled by Randomness

- The Hidden Role of Chance in Life and in the Markets

By: Nassim Nicholas Taleb

- Narrated by: Sean Pratt

- Length: 10 hrs and 3 mins

- Overall 4.5 out of 5 stars 5,646

- Performance 4.5 out of 5 stars 4,346

- Story 4.5 out of 5 stars 4,324

This audiobook is about luck, or more precisely, how we perceive and deal with luck in life and business. It is already a landmark work, and its title has entered our vocabulary. In its second edition, Fooled by Randomness is now a cornerstone for anyone interested in random outcomes.

Pass on this one and read The Black Swan

- By Wade T. Brooks on 06-25-12

The Education of a Value Investor

- My Transformative Quest for Wealth, Wisdom and Enlightenment

By: Guy Spier

- Narrated by: Malk Williams

- Length: 6 hrs and 28 mins

- Overall 4.5 out of 5 stars 1,955

- Performance 4.5 out of 5 stars 1,662

- Story 4.5 out of 5 stars 1,657

What happens when a young Wall Street investment banker spends a small fortune to have lunch with Warren Buffett? He becomes a real value investor. In this fascinating inside story, Guy Spier details his career from Harvard MBA to hedge fund manager. But the path was not so straightforward. Spier reveals his transformation from a Gordon Gekko wannabe, driven by greed, to a sophisticated investor who enjoys success without selling his soul to the highest bidder.

Malk Williams does a superb job.

- By Guy Spier on 11-30-14

The Snowball

- Warren Buffett and the Business of Life

By: Alice Schroeder

- Narrated by: Kirsten Potter

- Length: 36 hrs and 58 mins

- Overall 4.5 out of 5 stars 7,322

- Performance 4.5 out of 5 stars 6,180

- Story 4.5 out of 5 stars 6,161

Here is THE book recounting the life and times of one of the most respected men in the world, Warren Buffett. The legendary Omaha investor has never written a memoir, but now he has allowed one writer, Alice Schroeder, unprecedented access to explore directly with him and with those closest to him his work, opinions, struggles, triumphs, follies, and wisdom. The result is the personally revealing and complete biography of the man known everywhere as "The Oracle of Omaha."

2,220 well-invested minutes!

- By BogKid on 01-07-09

Liar's Poker

- RIsing Through the Wreckage on Wall Street

By: Michael Lewis

- Narrated by: Michael Lewis

- Length: 10 hrs and 16 mins

- Overall 4.5 out of 5 stars 1,412

- Performance 5 out of 5 stars 1,175

- Story 4.5 out of 5 stars 1,168

In 1986, before Michael Lewis became the best-selling author of The Big Short , Moneyball , and Flash Boys , he landed a job at Salomon Brothers, one of Wall Street’s premier investment firms. During the next three years, Lewis rose from callow trainee to New York- and London-based bond salesman, raking in millions for the firm and cashing in on a modern-day gold rush. Liar’s Poker is the culmination of those heady, frenzied years - a behind-the-scenes look at a unique and turbulent time in American business.

- By Anonymous User on 02-08-22

The Warren Buffett Way

- 3rd Edition

By: Robert Hagstrom

- Narrated by: Stephen Hoye

- Length: 10 hrs and 31 mins

- Overall 4.5 out of 5 stars 1,451

- Performance 4.5 out of 5 stars 1,207

- Story 4.5 out of 5 stars 1,200

Warren Buffett remains one of the most sought-after and watched figures in business today. He has become a billionaire and investment sage by buying chunks of companies and holding onto them, managing them as businesses, and eventually reaping huge profits for himself and investors in Berkshire Hathaway. The first two editions of The Warren Buffett Way gave investors their first in-depth look at the innovative investment and business strategies behind the spectacular success of living legend Warren E. Buffett.

Suggest getting the print copy.

- By Kevin Martin on 10-25-15

Publisher's summary

Humorous and entertaining, this book exposes the folly and hypocrisy of Wall Street. The title refers to a story about a visitor to New York who admired the yachts of the bankers and brokers. Naively, he asked where all the customers' yachts were? Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their bankers and brokers. Full of wise contrarian advice and offering a true look at the world of investing, in which brokers get rich while their customers go broke, this book continues to open the eyes of investors to the reality of Wall Street.

- Unabridged Audiobook

- Categories: Money & Finance

More from the same

- The Pursuit of God

- The Relationship Dismount

What listeners say about Where Are the Customers' Yachts?

- 4.5 out of 5 stars 4.4 out of 5.0

- 4.5 out of 5 stars 4.6 out of 5.0

Reviews - Please select the tabs below to change the source of reviews.

Audible.com reviews, amazon reviews.

- Overall 4 out of 5 stars

- Performance 5 out of 5 stars

- Story 5 out of 5 stars

- Srisai Vikash Akkineni

Keep reading and finish this book for a good laugh!

Funny, informative, and generally light on material and wisdom. This book was definitely worth a read for a couple of good laughs. And the author is not wrong. The world needs Wall Street. But nobody, not even those on Wall Street, can truly know what they are doing when it comes to investing due to psychological, social, and political forces.

Something went wrong. Please try again in a few minutes.

You voted on this review!

You reported this review!

1 person found this helpful

- Overall 5 out of 5 stars

- Anonymous User

entertaining and enduring

markets and investors haven't changed much over last century. concise , insightful, and funny. recommended for anyone want to get an honest and piercing take and wall street

Laughing at myself, most enjoyably

No one, having dabbled in active securities trading for longer than a year, should put off reading this book, even a moment longer. You owe it to yourself to take a good, solid look in the mirror and explore the mirth of seeing the absurdity of it all. I still trade and will still trade and will likely make a tradition of reading this book at the end of every fiscal year.

- Overall 1 out of 5 stars

- Story 1 out of 5 stars

- James R. Eagleton Jr.

I doubt that Warren Buffett ever recommended this book

This book is not funny and it has no material of value to me whatsoever

- Story 4 out of 5 stars

Great read after working with Private equity

most people on Wall Street aren’t any luckier or any smarter than the average person. After working with Private Equity I came to really appreciate the humor. Hit me at the right time

Surprisingly good!

I was blown away by how entertaining and insightful this book is, considering how long ago it was written.

Comedy more than anything

Was a descent book, more comedy about wall street than anything else. Still worth a listen for entertainment only

Pretty funny

Very entertaining. I did get a few laughs out of it. Great advice in a not direct way.

Relevant Insights for today

Amazing to think this was written so long ago…. Demonstrates that Wall Street hasn’t changed much

- Overall 2 out of 5 stars

- Performance 4 out of 5 stars

- Kindle Customer

the intro was the best part

I did not like this book. First, the book is only 4 hours long. However, there are 3 introductions. this leaves the book at 3 and a half hours. Second, the prose of the main text is nothing like the story provided in the sample (which is from one of the introductions). Third, the book tells no stories. It is a wordy tongue in cheek attempt at humor describing various participants tied to the act of investing. On a positive side, the narration was good.

Please sign in to report this content

You'll still be able to report anonymously.

People who viewed this also viewed...

Business Adventures

- Twelve Classic Tales from the World of Wall Street

By: John Brooks

- Narrated by: Johnny Heller

- Length: 16 hrs and 53 mins

- Overall 4 out of 5 stars 1,363

- Performance 4 out of 5 stars 1,121

- Story 4 out of 5 stars 1,121

What do the $350 million Ford Motor Company disaster known as the Edsel, the fast and incredible rise of Xerox, and the unbelievable scandals at General Electric and Texas Gulf Sulphur have in common? Each is an example of how an iconic company was defined by a particular moment of fame or notoriety; these notable and fascinating accounts are as relevant today to understanding the intricacies of corporate life as they were when the events happened.

Interesting book

- By Jason on 01-31-15

Manias, Panics, and Crashes (Seventh Edition)

- A History of Financial Crises

- By: Robert Z. Aliber, Charles P. Kindleberger

- Narrated by: Alister Austin

- Length: 19 hrs and 25 mins

- Overall 4 out of 5 stars 80

- Performance 4 out of 5 stars 65

- Story 4 out of 5 stars 65

Manias, Panics, and Crashes is a scholarly and entertaining account of the way that mismanagement of money and credit has led to financial explosions over the centuries. This seventh edition of an investment classic has been thoroughly revised and expanded following the latest crises to hit international markets. Renowned economist Robert Z. Aliber introduces the concept that global financial crises in recent years are not independent events, but symptomatic of an inherent instability in the international system.

Lack of theoretical underpinning

- By Dr. Terence M. Dwyer on 09-20-21

By: Robert Z. Aliber , and others

Your Money and Your Brain

- How the New Science of Neuroeconomics Can Help Make You Rich

By: Jason Zweig

- Narrated by: Walter Dixon

- Length: 11 hrs and 39 mins

- Overall 4.5 out of 5 stars 131

- Performance 4.5 out of 5 stars 106

- Story 4.5 out of 5 stars 106

Zweig, a veteran financial journalist, draws on the latest research in neuroeconomics, a fascinating new discipline that combines psychology, neuroscience, and economics to better understand financial decision making. He shows why we often misunderstand risk and why we tend to be overconfident about our investment decisions. Your Money and Your Brain offers some radical new insights into investing and shows investors how to take control of the battlefield between reason and emotion. Your Money and Your Brain is as entertaining as it is enlightening.

Must read for someone who has lost money in stocks

- By Tanmay on 03-09-20

Sonho grande

- Como Jorge Paulo Lemann, Marcel Telles e Beto Sicupira revolucionaram o capitalismo brasileiro e conquistaram o mundo

By: Cristiane Correa

- Narrated by: Larissa De Lara

- Length: 8 hrs and 18 mins

- Overall 5 out of 5 stars 21

- Performance 5 out of 5 stars 19

- Story 5 out of 5 stars 19

Jorge Paulo Lemann, Marcel Telles e Beto Sicupira ergueram, em pouco mais de quatro décadas, o maior império da história do capitalismo brasileiro e ganharam uma projeção sem precedentes no cenário mundial. Nos últimos anos eles compraram nada menos que três marcas americanas conhecidas globalmente: Budweiser, Burger King e Heinz. Tudo isso na mais absoluta discrição, esforçando-se para ficar longe dos holofotes. Sonho grande é o relato detalhado dos bastidores da trajetória desses empresários desde a fundação do banco Garantia, nos anos 70, até os dias de hoje.

- By Felipe Tadeu Stemler on 05-01-23

Reminiscences of a Stock Operator

By: Edwin Lefevre

- Narrated by: Rick Rohan

- Length: 9 hrs and 52 mins

- Overall 4.5 out of 5 stars 3,196

- Performance 5 out of 5 stars 2,490

- Story 4.5 out of 5 stars 2,495

First published in 1923, this lightly fictionalized biography of Jesse Livermore, one of the greatest market speculators ever, is widely regarded as one of best investment books of all time. Reminiscences of a Stock Operator is the resource that generations of investors have turned to when they needed deeper insight into their own investing habits and those of others. Listen to this work, featuring narrator Rick Rohan, and you'll soon discover your portfolio growing in new and unexpected ways!

OUTSTANDING

- By XEVEN on 11-21-09

- Make as Much Money as You Damn Well Want and Live Your LIfe as You Damn Well Please!

By: Dan Lok

- Narrated by: Dan Lok

- Length: 4 hrs and 50 mins

- Overall 4.5 out of 5 stars 2,125

- Story 4.5 out of 5 stars 1,820

Are you tired of the rat race? Do you wish you had more time and more money? Would you like to never work again? If you answered "yes!", then you need to look no further than Dan "The Man" Lok's new book - F.U. Money . In this no-nonsense, no-holds-barred guide, international entrepreneur, best-selling author, and self-made multi-millionaire Dan Lok shows you how to live the lifestyle you really want without having to work or rely on anyone else for money.

Nothing specific

- By Freedom Fitness World on 06-14-18

More Than You Know

- Finding Financial Wisdom in Unconventional Places

By: Michael J. Mauboussin

- Narrated by: Sean Runnette

- Length: 7 hrs and 27 mins

- Overall 4.5 out of 5 stars 206

- Performance 4.5 out of 5 stars 177

- Story 4.5 out of 5 stars 175

Since its first publication, Michael J. Mauboussin's popular guide to wise investing has been translated into eight languages and has been named best business book by BusinessWeek and best economics book by Strategy+Business . Now updated to reflect current research and expanded to include new chapters on investment philosophy, psychology, and strategy and science as they pertain to money management.

Liked it better when it was written by Taleb

- By Ian on 11-24-18

Hedge Fund Market Wizards

- How Winning Traders Win

By: Jack D. Schwager

- Narrated by: Clinton Wade

- Length: 16 hrs and 10 mins

- Overall 5 out of 5 stars 266

- Performance 4.5 out of 5 stars 228

- Story 5 out of 5 stars 226

From best-selling author, investment expert, and Wall Street theoretician Jack Schwager comes a behind-the-scenes look at the world of hedge funds, from 15 traders who've consistently beaten the markets. Exploring what makes a great trader a great trader, Hedge Fund Market Wizards breaks new ground, giving readers rare insight into the trading philosophy and successful methods employed by some of the most profitable individuals in the hedge fund business.

So much timeless wisdom

- By Rodney Williams on 08-24-20

Summary Poor Charlie’s Almanack

- The Wit and Wisdom of Charles T. Munger

By: Paul Jones

- Narrated by: Aedemon Maure

- Length: 32 mins

- Overall 5 out of 5 stars 5

- Performance 5 out of 5 stars 3

- Story 5 out of 5 stars 3

The book provides you with a concise summary of the key ideas and concepts covered in Poor Charlie's Almanack. Practical applications of Munger's principles in real-life scenarios, enabling you to make more informed decisions in your personal and professional life.

The Day the Bubble Burst

- A Social History of the Wall Street Crash of 1929

- By: Gordon Thomas, Max Morgan-Witts

- Narrated by: David Colacci

- Length: 21 hrs and 34 mins

- Overall 4.5 out of 5 stars 43

- Performance 5 out of 5 stars 37

- Story 5 out of 5 stars 37

The New York Times best seller that tells the story of an overheated stock market and the financial disaster that led to the Great Depression of the 1930s. A riveting living history about Black Tuesday, October 29, 1929. Captures the era, the intoxicating expectancy, the hope that ruled men's heart and minds before the bubble burst and the black despair of the decade that followed.

Thorough and fascinating

- By Bowen Florsheim on 04-23-21

By: Gordon Thomas , and others

- Help Center

- Redeem promo code

- About Audible

- Business Inquiries

- Audible in the News

- Accessibility

- ACX for Creators

- Bestsellers

- New York Times Best Sellers

- New releases

- Non-English Audiobooks

- Latino & Hispanic Voices

- Audible in Chinese

- How to listen

- Listen on Apple Devices

- Listen in the car

- Whispersync for Voice

- Everything Advanced Search

Where Are the Customers' Yachts?

Or A Good Hard Look at Wall Street

Find similar titles by category

Book Summary of Where are the Customers’ Yachts

Key takeaways and quotes from a classic book on markets and the investment business.

Where are the Customers’ Yachts was written in 1940 by Fred Schwed, an investment professional. It’s one of my favorite books on markets and I’m sure it will still be timeless 80 years from now.

The origin of the title:

Here are my takeaways from the book plus some great quotes:

- Making money is different than sounding smart. “I don’t know” is the most difficult answer – but usually the correct one. Some financial professionals have invented a new language for saying nothing in a variety of ways.

- Knowing a problem doesn’t mean you know the solution. For example, some Canadian pension funds are leveraging their portfolios because low expected returns raise the likelihood of future deficits. They identified a problem – but I’m not confident the solution is to lever up ten years into an economic expansion with high valuations and low yields.

- The biggest problem for most investors is their own emotions. This is a trope in financial writing – but it’s so true. If you constantly jump between different strategies you’ll look up at 65 and have little to show for all your years of saving. The best portfolio is the one you’ll actually stick with.

- Safe investments can fall out of fashion. Canal bonds were considered safe until railroads upended the canal industry. Russian government bonds were staples of European investment portfolios until the 1917 revolution wiped out their value.

- The truth about most investors. Most investors don’t admit they are expert rationalizers in finding profound reasons for hunches. “The inability to grasp ultimate realities is the outstanding mental deficiency of the speculator.” Some investors would rather go broke than admit their guess was wrong.

- The ability to sit still is a superpower. Most people “suffer from the inability to do nothing.” Some investors want to own as many securities as possible. Occasionally I get asked why I don’t make satellite allocations to assets like REITs or gold. I wrote a post showing why. A 5% tilt might make an investor feel diversified but it doesn’t impact portfolio performance.

The book is a rare combination of wisdom and wit – I highly recommend it. You can find used copies on Amazon for $5.

- Share on Twitter

- Share via Email

- Financial Planning

- Specialties

- Client Portal

Where Are The Customers' Yachts?

Fred Schwed's iconic 1955 book "refers to a story about a visitor to New York who admired the yachts of the bankers and brokers. Naively, he asked where all the customers' yachts were. Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their bankers and brokers."

Since then, how much has changed?

Do you know what your investments are costing you? If you’re not sure, you’re not alone. It’s not like you’re handed a menu of charges to choose from when it’s time to place your order. Even when you know where to look for financial costs, the information can be difficult to digest.

Let’s fill in some of the blanks by covering three significant sources of investment costs: fund management fees, (trading) costs, and advisor costs.

Fair Fund Management Fees

We typically invest in a mix of funds towards efficiently capturing global returns without having to juggle thousands of individual securities at a time. With most client portfolios holding tens of thousands of individual securities, what a task that would be!

Cost-effective diversification is a common strategy, and the basis for many popular investment options, including Vanguard's LifeStrategy Funds and more concentrated funds including the iShares Core S&P 500 ETF . In exchange, the Vanguard or iShares managers seek reasonable compensation for their services.

What’s “reasonable”? To discover how much fund management is costing you, start by looking for each fund’s expense ratio . You can find this information in the fund’s prospectus, or by searching online for its name or ticker symbol. Many broad market index mutual funds or ETFs have annual expense ratios of 0.02% (2 basis points) or less. If a fund’s annual expense ratio approaches 1% (100 basis points) or more, we advise caution - almost certainly, you should think twice about investing in it.

Some fund managers also pile on extra fees, or loads, beyond the ones reflected in their expense ratios. These should also be disclosed in the fund’s prospectus, and can include:

- A one-time front-end load when you buy shares of the fund

- A one-time back-end load when you sell shares of the fund

- Similar contingent deferred sales charges (CDSCs) and other redemption fees

Hiding and Seeking Fund Fees

Because fund management fees are typically bundled into each fund’s share price, you’ll barely notice they’re there. But they still cost you real money.

For example, in a recent working paper, “ Obfuscation in Mutual Funds ,” academics from the University of Washington, MIT, and The Wharton School at the University of Pennsylvania compared the 2019 costs and performances of two S&P 500 Index mutual funds. Before fees , their gross returns were nearly identical at 31.46% vs. 31.47%.

But one fund manager charged a lean 0.02% (2 basis points). The other one charged up to an all-in 5.08% (508 basis points). Once you know that, it’s easy to tell which fund will leave more money in your pocket after fees .

Are you having trouble finding a fund manager’s fees to begin with? Consider this central finding from the same paper :

“...we find evidence consistent with funds attempting to obfuscate high fees.”

In other words, the study found that lower-cost funds usually provided short, easy-to-understand fee disclosures; the higher-cost funds often buried their costs in lengthy and complex legalese .

Why complicate things? When searching for a particular type of investment, there are almost always funds available that do not charge loads and similar add-ons, and do clearly disclose their costs.

Comparing Costs

Low costs are important. But they’re not the only reason to favor one fund over another. Some investments cost more to manage because it’s more expensive to participate in their target market.

For example, an investment in a U.S. market fund will usually have lower expenses than an investment in a non-U.S. market fund. So, first, identify available investments that fit your unique investment goals. Compare their expense ratios, apples to apples. Weed out any funds that charge loads, or bury their fee disclosures in long-winded blather. Then select suitable funds with the lowest costs.

(Trading) Costs

In addition to your fund management costs, custodians, brokers, and trading platforms also make money off your investment activities. Take a step back from the mutual funds, ETFs, or other holdings you decide to invest in to consider where these holdings live and reside—and what does it cost to buy, sell, and hold them?

An Account of Your Accounts

First, let’s define a few terms:

Investment Accounts:

It’s easy to answer where your holdings live. They live in two main types of investment accounts:

- Individual accounts, which you set up and manage on your own (along with your advisor).

- Employer accounts, such as 401(k) or 403(b) plans, which your employers set up and may manage for you.

Custodians/Brokers:

There are two places where your individual and employer accounts typically reside:

- Traditional custodians, like Schwab, Vanguard, or Fidelity.

- Online platforms or “robo-advisors,” like Robinhood, Wealthfront Advisers, or Schwab Intelligent Portfolios®.

All of these "places" are known as custodians. Just like a bank holds your cash, a custodian holds your investment assets.

Your custodian uses brokers to execute your investment trades. Some custodians double-duty as the broker; others contract with third parties.

The Cost of Doing Business

So far, so good? Now that you’ve got a lay of the land, here’s an important insight …

It really doesn’t matter which types of accounts you’ve got, or where your holdings reside. You’re not the one trading in the market. You (or your advisor) places trading orders . Your account custodian takes it from there. Therein lies additional costs: the costs of holding and trading everything you’ve got.

Those “Free” Frills Can Cost You

Until a few years ago, brokers would almost always charge a commission whenever they executed a trade for you. In a more recent “ race to zero ,” many providers are now touting commission-free trading. But is that trading really free? If you take one thing from today’s piece, here it is:

As an investor, whenever you’re being led to believe you’re getting something for nothing, your best bet is to assume exactly the opposite.

It stands to reason: Custodians and brokers must be profitable, or they’d go out of business. If they’re not charging a commission on your trades, they’re still making money somehow. It’s just not where you’d expect to see it, nor can you tell how much it’s really costing you.

Tricks of the Trading Trade

Unfortunately, hidden costs usually mean higher costs. Following are a few tricks of the trading trade that often replace or augment more transparent pricing.

Cash Sweeps and Lending Practices:

Ideally, you actually invest most of the money you’ve earmarked for investing. But you probably also hold a little or a lot of cash in your investment accounts. Some custodians have been profiting handsomely by quietly sweeping this cash into their in-house, low-rate bank accounts, instead of paying you market-rate interest. They can then reinvest your cash in higher-rate holdings, or lend it out and earn interest on it—and keep the difference for themselves. Add everyone’s cash together, and the profits can pile up.

To illustrate, a 2018 San Francisco Chronicle piece reported average money market rates were around 2% at the time, while average bank sweep accounts were paying closer to 0.27%. The article described these practices as “similar to the way many airlines have cut fares and made up for it with fees for baggage, seat assignments and overpriced food.”

Payment for Order Flow:

As described above, your custodian arranges for your trades to be executed. In theory, they’re required to seek “best execution” for your trades. In practice, one common technique is to use payment for order flow to seek competitive trading bids from third parties. Sometimes, this can generate more competitive pricing that benefits you. But it also can create conflicting incentives if an entity offers your custodian more payment (for them), without also ensuring best execution (for you).

Platforms have been under scrutiny on this front, including a 2020 U.S. Securities and Exchange Commission (SEC) charge that Robinhood was misleading customers about the true costs of their trades. Neither admitting to nor denying the charge, Robinhood paid a $65 million fine and agreed to review their payment for order flow and other best execution policies and procedures.

Bond markups/markdowns:

If you’re trading in individual bonds, there are usually significant hidden costs known as markups and markdowns. When bonds are bought and sold, there is the equivalent of a “wholesale” versus “retail” price. The markup/markdown is the difference you pay above the “wholesale” price. This undisclosed difference typically goes to the broker, in addition to any disclosed commissions paid.

According to Investopedia, " The commission can range from 1 to 5% of the market price of the bond. "

Advisory Costs

Before we wrap, let’s talk about our own advisory costs.

These days, you don’t need an advisor to manage everything we just discussed. You can look up fund expense ratios on your own, and watch for loads and other fees. You can set up and fund your individual accounts, and decide how you’d like to invest your retirement plan assets at work. You can be diligent about minimizing uninvested cash in your investment accounts.

That's why we suggest nine different commission-free options in the Costs section of our website at www.openwindowFS.com/costs .

As an independent, fee-only, fiduciary advisor, we certainly help our clients with all these logistics, and more. But more than that, we provide professional, objective advice on everything related to your total wealth:

We advise you on managing your wealth across your total investment portfolio, wherever your accounts may reside . If your only advice comes from a custodian or trading platform, it’s likely to only apply to your investments with them, without considering assets you hold elsewhere. Plus, if you could do better elsewhere, don’t expect to hear about it from them.

We advise you on your total wealth interests . Do your investments best reflect your personal financial goals and risk tolerances? How should you use insurance to protect your wealth? How can you spend safely in retirement, and which accounts should you spend down first? What about Social Security? Are your estate plans up to date, with accurate beneficiaries across your various accounts and policies? How can you effectively draw personal wealth out of your business? What about those corporate stock options? How can you integrate your charitable giving with optimal tax planning? These are just a taste of the areas we advise on.

We advise you according to your highest financial interests . Even “free” trading can be horribly expensive if it runs counter to achieving your greatest financial goals. In our fiduciary relationship with you, we’ll show you how to minimize hyperactive trading, make the most of the market’s available returns, and manage the very real risks involved. A commission- or fee-based advisor representing others’ interests is unlikely to do the same.

When you hire Open Window as your independent, fee-only advisor, you are purchasing our all-in fiduciary advice. Our costs are clearly disclosed and are our sole source of compensation. Our clients know the exact cost, with no commissions, no kickbacks, no surprises. Helping families illuminate and eliminate excessive investment costs is one way we strive to "pay our own way" as an advisor.

When done right, our cost is a small fraction of the value we offer:

- By helping you make better decisions, make them earlier, and by avoiding costly errors.

- By seeking a long-term investment return that exceeds other comparable options.

- By seeking a lower lifetime tax burden, and the benefits of tax-efficient wealth transfer and charitable giving.

- By helping to provide peace of mind while saving you time and energy.

If you’d like to explore further how we can enhance your own financial experience, please be in touch with us today at www.openwindowFS.com/connection .

July 21, 2021

Where are the customer’s yachts?

Dividend Investing , REITs

Written by:

Christopher Ng Wai Chung

In 1955, Fred Schwed wrote a book entitled “ Where are the customer’s yachts”, where someone visited the harbours of New York and found the waters littered with luxury yachts belonging to bankers and brokers who made it big on Wall Street.

The visitor then asked the guide a naïve question: “Where are the customer’s yachts?”

The book raises an important point about the financial industry , giving financial advice was highly lucrative, but receiving and acting upon that advice was not.

Because if advice worked, there would be more yachts belong to the customers.

The customer’s yacht: An ERM graduate’s $500,000 portfolio

The Early Retirement Masterclass (ERM) program has graduated 21 batches or 552 alumni. Being a program that has run for three years, we are finally seeing an opportunity to present some of the more stellar results coming out from the program.

One student was kind enough to allow me to pay a visit to his “yacht”, hints of a lifestyle based on adopting 12 sample portfolios of the ERM program.

Student M, a finance professional in his mid-30s, attended my program as part of Batch 10, which was conducted in December 2019. I was not aware of his stellar performance until he participated in a refresher session last weekend.

I designed ERM so that all portfolios built by each batch are accessible in a private Early Masterclass Facebook group. So M was able to gain access to the portfolios constructed by batches 11 through 21.

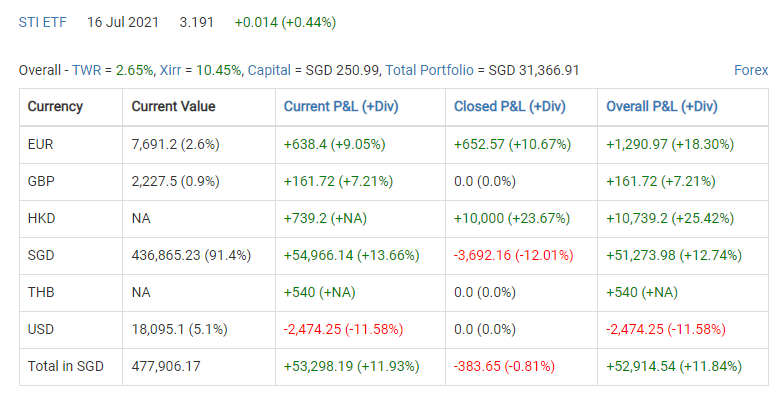

In less than two years after attending the ERM course, M achieved the following mind-boggling results.

M accumulated almost half a million worth of stocks in his account with an internal rate of return of 10.45%.

About half of the portfolio is his equity, and the other half are borrowed funds from his broker.

But wait, there’s more. What’s interesting is that M’s wife, who is also a high flyer in the finance industry, has a larger portfolio based on the same set of stocks. This is a million dollars worth of stocks in a margin account after less than two years of accumulation!

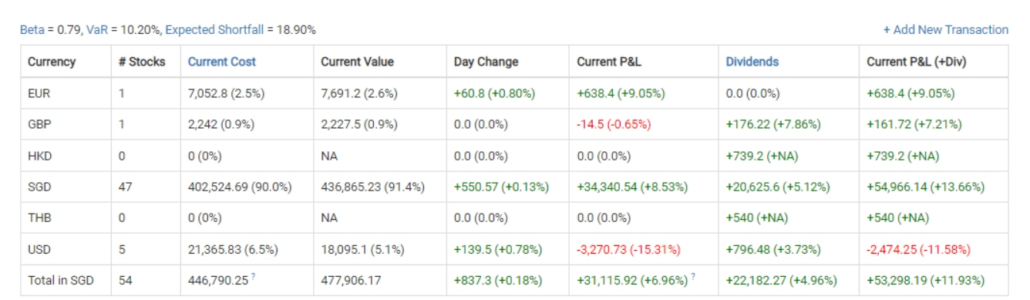

Examining his portfolio in closer detail, we get the following results:

We can find the classic properties of an ERM portfolio here: a beta of around 0.8 , indicating a risk lower than the rest of the market and almost half of all gains arising from dividend payouts.

M produced dividend payments of $22,182 over a short span of two years.

3 tips from a successful ERM graduate

During the lab session last week, M shared some tips on maximising the utility of the knowledge gained in the ERM program.

1 – Ignore market downturns

The fact of the matter is that M did not join ERM at the best of times . December 2019 was almost the market peak before the pandemic crash. If you had followed Batch 10, based on my records on Stocks café, you have lost up to 24% at the depths of the pandemic.

This would have been enough for many students to throw in the towel, declare the trainer a charlatan, and give up investing for good.

M explained that he did the opposite and tried to adapt my approach during the recession of 2009. He kept building up new portfolios and farmed his income into his margin account to buy more stocks.

Throughout this entire process, the Singapore stock market turned from being the worse stock market in Asia in 2020 into an outperformer in 2021.

2 – Have the courage to employ financial leverage

Another aspect of M’s approach was that he was a steadfast supporter of leverage , which is also highly unusual given that he endured the pandemic crash at ground zero.

M employed an equity multiplier of x2 throughout the pandemic crash. In other words, for every dollar that he and his wife has farmed into the portfolio, he borrowed one dollar more from his margin broker—doing this required “balls of iron”, as Batch 10 could have been down 24% at its lowest point. As M employed leverage, he would be nursing a loss of approximately 51% in March 2020.

So his current performance of 10.45% was closer to about (10.45% x 2 – 3%) or 17.9% assuming his margin financing costs of 3%.

3 – Maintain a high earning power

An astute observer would note that M is hardly an ordinary Singaporean from an earnings standpoint. As a family unit, M’s family earns easily within the top 10% bracket of taxpayers in Singapore.

Both he and his wife are successful PMETs in the finance industry. He shared that with their combined incomes, they could farm up to $30,000 into every portfolio published by the ERM program, and in the months when I did not conduct training, he would perform his screening and build his portfolio for a fresh injection of these funds.

When I asked M whether he made lifestyle adjustments to build the portfolio, he replied that he did not have to. Still, he said that switching employers once every 3 to 4 years helped increase portfolio growth rate quite drastically.

I get that most of us earn a more ‘average’ salary, I wasn’t even in the top 10% bracket when I was building my own ERM portfolio. That said, most ‘average’ folks like us can practically work towards owning our yacht.

Even without a yacht, M is a shining example for future ERM students

Finally, I would like to apologise to the reader who was expecting a picture of M’s yacht. He does not own one yet, but he did share that he actually intends to downgrade to living in a HDB in Singapore and build a palatial mansion in Thailand instead. For this alone, I’m cautiously optimistic that he would easily be able to afford a yacht one day.

M’s family is highly likely to will their first million dollars of net worth if they continue along this path. They manage their earnings very astutely, can save a generous portion of their profits, and has shown grit and determination to leverage an ERM portfolio even through the pandemic.

ERM is lucky to have someone like M on board. He is a brilliant showcase of what an actionable investment workshop can do for your life.

S-REITs Portfolio Performance: DIY versus ETF

Do Singapore REITs have a place in our portfolio?

Zhi Rong Tan

Leave a Comment Cancel reply

Bogleheads.org

Investing Advice Inspired by Jack Bogle

Skip to content

- Forum Policies

- Support this Site

- Board index US Investors Investing - Theory, News & General

Fred Schwed: Where are the Customers Yachts? Summary

Post by captmorgan50 » Mon Mar 20, 2023 2:03 am

Re: Fred Schwed Where are the Customers Yachts? Summary

Post by captmorgan50 » Mon Mar 20, 2023 2:04 am

Post by David Jay » Mon Mar 20, 2023 3:12 am

Post by David Jay » Mon Mar 20, 2023 3:19 am

Post by er999 » Mon Mar 20, 2023 3:37 am

Post by captmorgan50 » Mon Mar 20, 2023 3:40 am

Post by Carol88888 » Mon Mar 20, 2023 4:11 am

Post by captmorgan50 » Mon Mar 20, 2023 3:24 pm

Post by Bill Bernstein » Mon Mar 20, 2023 3:57 pm

Post by captmorgan50 » Mon Mar 20, 2023 7:43 pm

Bill Bernstein wrote: ↑ Mon Mar 20, 2023 3:57 pm Not to steal the OP's thunder, but here's my fave: In 1929 there was a luxurious club car which ran each week-day morning into the Pennsylvania Station. When the train stopped, the assorted millionaires who had been playing bridge, reading the paper, and comparing their fortunes, filed out of the front end of the car. Near the door there was placed a silver bowl with a quantity of nickels in it. Those who needed a nickel in change for the subway ride downtown took one. They were not expected to put anything back in exchange; this was not money – it was one of those minor conveniences like a quill toothpick for which nothing is charged. It was only five cents. There have been many explanations of the sudden debacle of October, 1929. The explanation I prefer is that the eye of Jehovah, a wrathful god, happened to chance in October on that bowl. In sudden understandable annoyance, Jehovah kicked over the financial structure of the United States, and thus saw to it that the bowl of free nickels disappeared forever.

Post by Harmanic » Mon Mar 20, 2023 8:56 pm

captmorgan50 wrote: ↑ Mon Mar 20, 2023 2:03 am • Rarely will it be the most difficult of all answers---“I don’t know.”

Post by Bill Bernstein » Tue Mar 21, 2023 12:10 am

Post by captmorgan50 » Tue Mar 21, 2023 1:48 am

Bill Bernstein wrote: ↑ Tue Mar 21, 2023 12:10 am Thanks for the kind words. I assume you're referring to VDE/VENAX having near zero foreign holdings. I guess I'm fine with that, I'm not willing to pay 30 more bp to get the foreign exposure from say, IXC.

Re: Fred Schwed: Where are the Customers Yachts? Summary

Post by LadyGeek » Tue Mar 21, 2023 1:49 am

Return to “Investing - Theory, News & General”

- US Investors

- ↳ Personal Investments

- ↳ Investing - Theory, News & General

- ↳ Personal Finance (Not Investing)

- Non-US investors

- ↳ Non-US Investing

- ↳ Canada - Financial Wisdom Forum

- ↳ Spain - Bogleheads® España

- ↳ Spain

- ↳ United Arab Emirates

- ↳ The Bogleheads® Wiki: a collaborative work of the Bogleheads community

- ↳ Canada - finiki (wiki)

- ↳ Personal Consumer Issues

- ↳ Local Chapters and Bogleheads Community

- ↳ US Chapters

- ↳ Wiki and Reference Library

- ↳ Non-US Chapters

- ↳ Calendar of Events

- ↳ Forum Issues and Administration

- Board index

- All times are UTC

Powered by phpBB ® Forum Software © phpBB Limited

Privacy | Terms

Time: 0.369s | Peak Memory Usage: 1.11 MiB | GZIP: Off

latest in US News

Serial killer on death row for decades finally faces execution...

3-year-old boy missing after mom sent him to male friend's home...

Fla. congressman defends Trump's 'racist' comments on black...

Ex-NYPD commish says NYC quality of life has 'really...

OK lawmaker calls LGBTQ people 'filth' following beating death of...

Beloved NYC owl Flaco's official cause of death revealed

Family of slain Georgia nursing student recall their 'amazing...

Brazen teens use SUV as ‘battering ram’ to steal nearly $600K...

San francisco store requires customers to shop with employee escort to curb ‘rampant shoplifting’.

- View Author Archive

- Get author RSS feed

Thanks for contacting us. We've received your submission.

A San Francisco store is no longer allowing customers to roam around and shop without being escorted by an employee in an attempt to stop “rampant shoplifting,” according to a report.

Fredericksen’s Hardware and Paint in the city’s Cow Hollow neighborhood has put up a sign announcing that during certain hours it will be taking customers only one at a time to curb the incessant thefts.

The shop is blocking off part of the store’s entrance and corralling shoppers in a waiting area until an employee is able to help them, KRON4 reported .

“Attention shoppers,” the sign reads. “Due to the rampant shoplifting, Fredericksen has introduced a one-on-one shopping experience: wait here and a clerk will be right with you to help you with all your shopping needs.

“We’re sorry for the inconvenience,” the notice concludes.

The store’s longtime manager, Sam Black, told the outlet that while the move could be a nuisance to customers it was worth trying for the sake of the business and its employees.

He said the shoplifting is the worst it’s ever been in his 24 years working at the business in the Golden Gate City, which is grappling with surging crime .

The staff has even had to drill down pots and pans to keep shoplifters from snatching them. They’ve also had to lock up tools and other hardware products.

“It’s pretty bad,” Black said. “I mean, the dollar amounts are pretty significant, and with the tools and now we’re getting snatch-and-grabs when they take whole displays, so it’s getting kind of dangerous for the employees and the customers.”

The new rules are in effect for two hours in the morning and two hours in the evening, Black said. A table blocks the entrance to keep thieves from entering the store unattended.

“We just want to make it uncomfortable for the thieves so they go somewhere else,” Black said.

One customer told KRON4 the situation is “just sad.”

“Yeah, people aren’t happy,” Black said. “The regulars can’t believe it like we can’t believe it, but they’ve been really understanding.”

The security experiment has been going on for three weeks now, Black said. He said the store will review the results at the end of the month.

San Francisco supervisor Catherine Stefani called the situation “embarrassing” for the city.

“This situation is tragic and embarrassing for our city, and it’s all the more reason to get serious about solving our police staffing crisis,” she told the outlet in a statement. “We need more police on our streets, and we need them now.”

Other stores in San Francisco have abandoned their self checkout lines to stop criminals.

Share this article:

Advertisement

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

COMMENTS

Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their bankers and brokers. Full of wise contrarian advice and offering a true look at the world of investing, in which brokers get rich while their customers go broke, this book continues to open the eyes of investors to the reality of Wall ...

Rarely will it be the most difficult of all answers - "I don't know.". 3. On the cyclical nature of the markets: "When "conditions" are good, the forward looking investor buys. But when "conditions" are good, stocks are high. Then without anyone having the courtesy to ring a bell, "conditions" get bad.". 4. On the ...

Where Are the Customers' Yachts?: or A Good Hard Look at Wall Street Fred Schwed Jr., Peter Arno (Illustrator), Jason Zweig (Introduction) 3.91 2,343 ratings186 reviews "Once I picked it up I did not put it down until I finished. . . .

Fred Schwed's Where are the Customers' Yachts?: A modern-day interpretation of an investment classic: Gough, Leo: 9781906821333: Amazon.com: Books Books › Business & Money › Investing Enjoy fast, free delivery, exclusive deals, and award-winning movies & TV shows with Prime Try Prime and start saving today with fast, free delivery Kindle $7.99

Where Are the Customers' Yachts? by Fred Schwed Jr., Peter Arno - Audiobook - Audible.com Browse Sample Where Are the Customers' Yachts? or A Good Hard Look at Wall Street By: Fred Schwed Jr., Peter Arno Narrated by: Mark Moseley Length: 4 hrs and 2 mins 4.4 (130 ratings) Try for $0.00

The theory presented here explains why the customers'. yachts were not more conspicuous when Fred Schwed wrote his famous book, and why they probably won't be. in the future. It also shows why bankers, brokers or. anyone else perceived as having valuable information. will just naturally attract money. l.

The title came from a story about a visitor in New York more than a century ago. After admiring yachts Wall Street bought with money earned giving financial advice to customers, he wondered where ...

So begins Fred Schwed's marvelous classic, "Where Are the Customer's Yachts?"It is now a part of the IFA book collection.. If you do not have the good fortune to acquire either the original 1940 edition or the 1955 Bull Market edition, you can pick up the 2006 edition from Amazon, which will give you the benefit of delightful introductions from noted financial writers Jason Zweig and Michael ...

Recorded Books, Inc. English 4h 2m. audiobook. ratings. (16) by Fred Schwed. read by Mark Moseley. Or A Good Hard Look at Wall Street. Humorous and entertaining, this book exposes the folly and hypocrisy of Wall Street. The title refers to a story about a visitor to New York who admired the yachts of the bankers and brokers.

By Adam Collins On July 17 2019 Where are the Customers' Yachts was written in 1940 by Fred Schwed, an investment professional. It's one of my favorite books on markets and I'm sure it will still be timeless 80 years from now. The origin of the title: Source: Page 1 of Where are the Customers' Yachts

Details Select delivery location Only 1 left in stock - order soon. Add to Cart Buy Now Ships from GR8BUYS4U Sold by GR8BUYS4U Returns Eligible for Return, Refund or Replacement within 30 days of receipt See more Buy used: $6.49 $649 + $3.99 shipping Other Sellers on Amazon Add to Cart $24.78 & FREE Shipping Sold by: five star ten number See Clubs

"Where Are the C-C-Customers' Yachts? is a g-g-great read."—Charles Ellis, Managing Partner, Greenwich Associates "A delightful classic and reminder of excesses past and how little things change."—Bob Farrell, Senior Vice President, Merrill Lynch. Where Are the Customers' Yachts?

Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their bankers and brokers. Full of wise contrarian advice and offering a true look at the world of investing, in which brokers get rich while their customers go broke, this book continues to open the eyes of investors to the reality of Wall ...

Where Are the Customers' Yachts? initially published in 1940, is a book by Fred Schwed, Jr., a former trader on Wall Street and later author, after losing much of his wealth in the stock market crash of 1929. In his book, Schwed used wit and sarcasm to provide some transparency to the murkiness of the investment world.

February 5, 2022 Advisor Selection Investing. Fred Schwed's iconic 1955 book "refers to a story about a visitor to New York who admired the yachts of the bankers and brokers. Naively, he asked where all the customers' yachts were. Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their ...

In 1955, Fred Schwed wrote a book entitled " Where are the customer's yachts", where someone visited the harbours of New York and found the waters littered with luxury yachts belonging to bankers and brokers who made it big on Wall Street. The visitor then asked the guide a naïve question: "Where are the customer's yachts?"

Where Are the Customers' Yachts? 11 The Big Opportunity Later on that year, Mr. Broker called Joe and asked him to come down to Wheeler, Dealer, & Company as quickly as possible to discuss an incredible investment opportunity. When he arrived, Joe also saw Harry Bigbucks in the offi ce. At that moment, Joe truly felt like the major player he had

174 Follower s Summary In the book Where Are the Customers' Yachts, Fred Schwed Jr. uses great writing, humor, and his experience to discuss the craziness of the markets. Warren Buffett, Michael...

Fred Schwed's Where are the Customers' Yachts? A modern-day interpretation of an investment classic (Infinite Success) Kindle Edition by Leo Gough (Author) Format: Kindle Edition 3.9 303 ratings Part of: Infinite Success (21 books) See all formats and editions Kindle $7.99 Read with Our Free App Paperback $9.95 2 Used from $17.32 6 New from $9.95

Fred Schwed, Jr. was an American stock broker turned author, known for his book on Wall Street, Where Are the Customers' Yachts? Background. Schwed was born in New York. Schwed's father, Frederick Schwed, was a member of the New York Curb Exchange (renamed in 1953 to AMEX). He was a ...

Location: Michigan Re: Fred Schwed Where are the Customers Yachts? Summary by David Jay » Mon Mar 20, 2023 3:12 am Taylor Larrimore regularly reviews books and lists some of the pithy sayings in those books. These are called "Taylor's Gems", and they are on the Wiki at this link: https://www.bogleheads.org/wiki/Taylor_ ... tment_Gems

A San Francisco store is no longer allowing customers to roam around and shop without being escorted by an employee in an attempt to stop "rampant shoplifting," according to a report ...

For Customers. Bloomberg Anywhere Remote Login; Software Updates; Manage Products and Account Information; Support. Americas +1 212 318 2000. EMEA +44 20 7330 7500. Asia Pacific +65 6212 1000 ...

Where Are the Customers' Yachts?: : A Good Hard Look at Wall Street Kindle Edition by Fred Schwed (Author), Peter Arno (Illustrator), Jason Zweig (Introduction) Format: Kindle Edition 3.5 26 ratings See all formats and editions It's amazing how well Schwed's book is holding up after fifty-five years.